Each year HMRC conducts thousands of tax enquiries across the UK. These can be triggered by red-flags, or occasionally selected at random. HMRC’s Connect System selects 90% of all individuals or businesses who receive an enquiry notice.

A tax enquiry may involve any aspect of your affairs such as a simple accounts query, a VAT or PAYE check, a review of Directors’ personal tax returns, or a full-blown enquiry spanning many tax years. Both businesses and individuals can be subject to a tax enquiry. There is nothing that can be done to prevent the likelihood of an enquiry, however pro-active steps can be taken so that the financial and emotional impact of an enquiry on you or your business may be minimised.

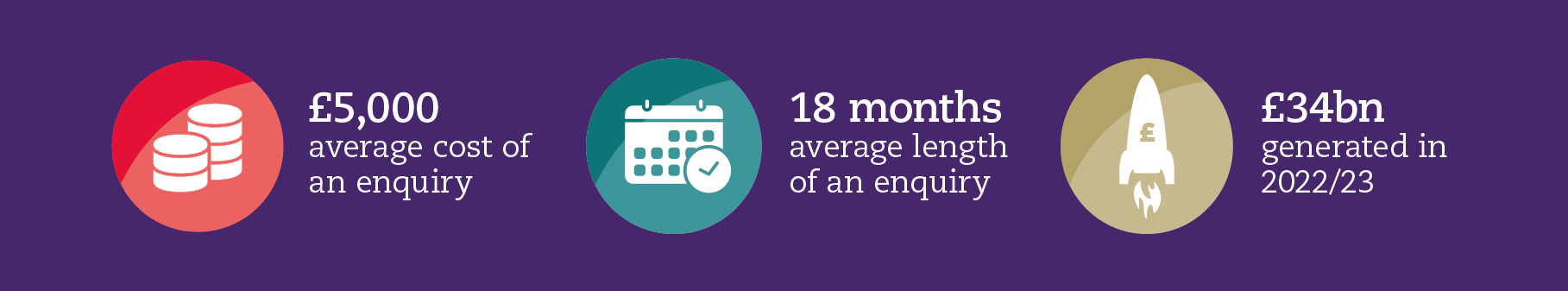

Did you know?

Source: Federation of Small Businesses and Markel Tax

Johnston Carmichael’s Tax Enquiry Service

At Johnston Carmichael, as your trusted adviser, we are able to offer you peace of mind from the financial burden of the professional fees associated with HMRC enquiries. Our annual Tax Enquiry Service will safeguard you and/or your business from the enquiry costs.

The Johnston Carmichael Tax Enquiry Service is backed by our own insurance policy with Markel Tax, and we are confident that the service delivers the most comprehensive protection against the potential fees arising from our professional representation in the event of an HMRC enquiry.

How it works

If you are selected, our experts will take control of the enquiry and liaise directly with HMRC on your behalf; working quickly to bring the enquiry to a conclusion. We will ensure that HMRC's concerns are identified and addressed quickly, with minimal fuss and disruption to you and your business, and that you only pay what is due. The defence fees incurred during the enquiry will be covered through our Tax Enquiry Service and we will support you through:

Full & aspect enquiries into:

- Corporation tax returns

- Partnership tax returns

- Sole trader tax returns

- Personal tax returns

- Trust returns

Disputes into:

- VAT

- Employer compliance

- IR35

View a summary of the services available under the Johnston Carmichael Tax Enquiry Service.

Got a question?

For more information on any questions you might have about subscribing to a Tax Enquiry Service we have compiled some common questions. You can download these, here.

View our other services

Arrange a free consultation with the team now

Have a general enquiry? Get in touch.