Making Tax Digital is a key part of the Government's initiative to make it easier for individuals and businesses to get their tax right and keep on top of their affairs through a fully digital tax system.

Since April 2019, the majority of VAT registered businesses are within Making Tax Digital (MTD) for VAT. Every small business owner and individual taxpayer now has an HMRC digital account that they can access to check their records and manage their information.

Making Tax Digital for Income Tax

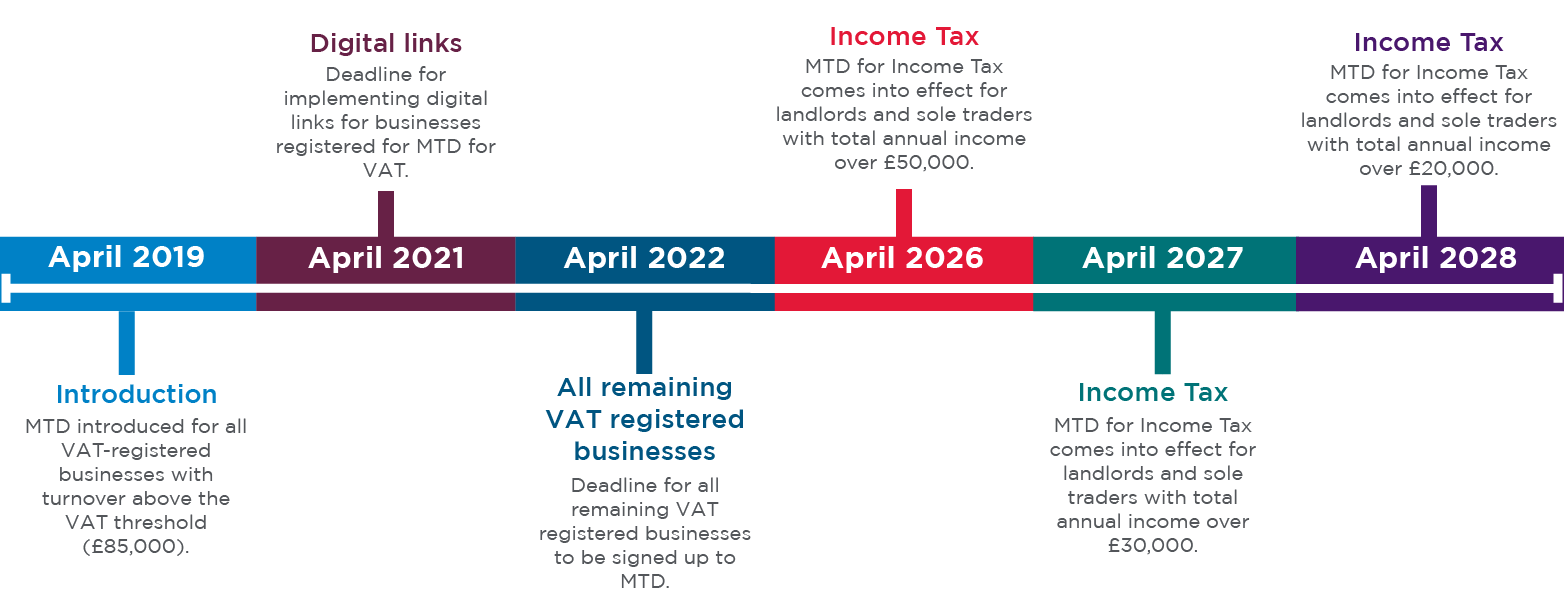

The roll out of Making Tax Digital for Income Tax begins now with qualifying individuals requiring to be registered for MTD for income tax by 5 April 2026. The timeline below illustrates future staging posts as MTD for Income Tax is rolled out across sole trade businesses and those with rental income (be that in the UK or overseas). In due course MTD for Income Tax will be rolled out to Partnerships too.

In terms of compliance, MTD for Income Tax requires you to maintain digital records of your income and expenses, and to send digital quarterly summaries to HMRC. Based on the figures you send each quarter, you'll receive an estimate of your tax liability. At the end of the tax year, you need to complete an MTD tax return, similar to the current self assessment tax return, at which point HMRC will inform you of your tax due for that year.

The introduction of the Making Tax Digital rules is the most fundamental change to the administration of the tax system for two decades. The changes are so fundamental, it's important to understand what's involved and what these rules mean for your business and personal income tax reporting.

Making Tax Digital for Income Tax

April 2026: MTD for Income Tax - £50,000 Threshold

Making Tax Digital for Income Tax Self-Assessment will come into effect for sole traders and landlords with a total annual income above £50,000. They will need to use compatible software to keep digital records and file returns, including sending quarterly updates and a final declaration each year.

April 2027: MTD for Income Tax - £30,000 Threshold

This stage will see the extension of MTD for Income Tax to sole traders and landlords with annual incomes above £30,000.

April 2028: MTD for Income Tax - £20,000 Threshold

This stage will see the extension of MTD for Income Tax to sole traders and landlords with annual incomes above £20,000.

Future developments

HMRC is considering how MTD for ITSA might apply to smaller businesses with annual incomes less than £20,000.

There are also plans for MTD for Partnerships but as yet no date has been given by HMRC.

How will Making Tax Digital help me manage my tax and my reporting?

It's hoped that keeping digital records will offer many benefits by helping businesses stay on top of their tax affairs and business planning. HMRC also believe that by keeping digital records, this will help taxpayers avoid errors.

Next steps

If you are within MTD for Income Tax from 6 April 2026 due to your turnover (before expenses) from your sole trade and/or rental income taking you over £50,000 in the tax year 2024/25, then you will be required to register for MTD for Income Tax before 6 April 2026.

Step 1 – Register for MTD pre-1 April 2026

You will be required to register for MTD for Income Tax before 1 April 2026. The sign up facility is now open and we will be assisting our clients with signing up for MTD in advance of 1 April 2026.

If you wish to register for MTD yourself then this can be done via HMRC’s MTD sign up facility.

Please ensure you select that it’s April 2026 and not April 2025 registration that you are signing up for.

Step 2 – Choose MTD compatible software

Choose MTD compatible software, as this is essential once within MTD for Income Tax due to the need to keep digital records, and report income and expenses quarterly to HMRC via digital links.

Various software companies have produced MTD compliant software and we are working with our Digital Advisory team to highlight to our clients the most suitable software.

Step 3 – Submit your quarterly returns to HMRC

When registering for MTD, you will be able to choose to opt from the default of dates based on the tax year (see table 1 below), versus calendar quarters (see table 2 below).

Table 1 – Tax year quarters

| Period covered | Filing deadline | |

|---|---|---|

| Quarterly update 1 | 6 April - 5 July | 7 August |

| Quarterly update 2 | 6 April - 5 October | 7 November |

| Quarterly update 3 | 6 April - 5 January | 7 February |

| Quarterly update 4 | 6 April - 5 April | 7 May |

Table 2 – Calendar quarters

| Period covered | Filing deadline | |

|---|---|---|

| Quarterly update 1 | 1 April - 30 June | 7 August |

| Quarterly update 2 | 1 April - 30 September | 7 November |

| Quarterly update 3 | 1 April - 31 December | 7 February |

| Quarterly update 4 | 1 April - 31 March | 7 May |

The quarterly returns are cumulative, so if an error is discovered in a previous submission, it can be corrected the following quarter, together with correcting the underlying digital records.

Step 4 – Submit your end of year submission

After the fourth and final quarterly update has been submitted, you will be required to submit a MTD tax return. Whilst this will be similar to the current Self-Assessment return, it will also have some differences. For example, information from the quarterly returns will be populated into the tax return, however these will then need to be adjusted within the tax return for accounting and tax purposes.

Other non-business and non-property income will require to be reported on the MTD return as is the case currently. The self-assessment filing deadline will also be 31 January, following the relevant tax year for MTD tax returns.

Who is exempt from Making Tax Digital?

Making Tax Digital will apply to a range of taxpayers over time, including most businesses, self-employed people, landlords and individual taxpayers, but there are a few exceptions.

The exemption criteria for Making Tax Digital for Income Tax are similar to those for MTD for VAT. You can apply for an exemption from MTD for Income Tax if you consider yourself to be digitally excluded. This might be the case if it's not practical for you to use software for keeping digital records or submitting them, which could be due to reasons like age, disability, your location (such as a remote area with poor internet connectivity), or religious beliefs.

Just like with MTD for VAT, each application for exemption from MTD for Income Tax is considered on a case-by-case basis by HMRC. If HMRC has already confirmed your exemption from MTD for VAT for one of these reasons, then you still require to speak with HMRC separately to confirm if you will get an exemption from MTD for Income Tax.

If you don't have a justifiable reason for exemption and fail to comply with these requirements, you may face penalties. However, HMRC will offer alternative solutions to those who are granted an exemption.

For more detailed information, you can visit the gov.uk guidance page on applying for an exemption from Making Tax Digital for Income Tax.

Got a question?

If you would like to discuss this further, please don't hesitate to reach out to your usual Johnston Carmichael adviser or filling out our "Arrange a meeting" form.

View our other services

Arrange an initial conversation with our team

Have a general enquiry? Get in touch.