A Company Voluntary Arrangement (CVA) is a formal arrangement between an insolvent business and its creditors, and it can be a welcome solution to companies experiencing financial difficulty.

When your business becomes insolvent, it has several options for reducing its risk of being subject to legal action from creditors . One way is working out an arrangement to repay its debt over time through a CVA.

The biggest appeal of company voluntary arrangement to directors is that it is a 'debtor in possession' process, meaning the directors remain in control, which in turn means the professional costs for managing the process are significantly less than a full blown insolvency. A CVA also demonstrates the directors are seeking the best situation for all involved.

What are Company Voluntary Arrangements?

When your business becomes unable to pay its debts (insolvent) there are a number of formal insolvency process options available to reduce the risk of legal action by your creditors (your lenders). Through an unsecured creditors meeting options include: a company administration, which gives a third-party administrator control, and a pre-pack administration, which means your company assets are sold to a new company to allow it to keep trading.

Another option, which is more often than not the best option, is to propose a company voluntary arrangement (CVA) which details terms that allow your business to keep trading and repay the debt due to your creditors over a longer term schedule.

For this to be an option that creditors are likely to accept, it should offer a better outcome than alternative insolvency procedures. Creditor support is critical.

A CVA allows your company to pay off its debt over a longer time period than the original creditor terms may have allowed, which offers you a range of benefits.

The benefits of a CVA

- Your business is protected against legal action

- Directors retain control

- Debts are consolidated

- It reduces costs

- Your monthly cash flow becomes manageable again

- Your company avoids administration or insolvency

- Your employees jobs are protected for longer

COVID-19 had placed the travel industry in turmoil, with our income stream immediately turned off. We were asset rich, but cash poor and had to take decisive action. Having discussed the matter with JC, it became apparent that the CVA route was the vehicle to use, enabling the directors to retain control of the business.

Martin Super

Director, David Urquhart Travel Ltd

How long does a CVA last?

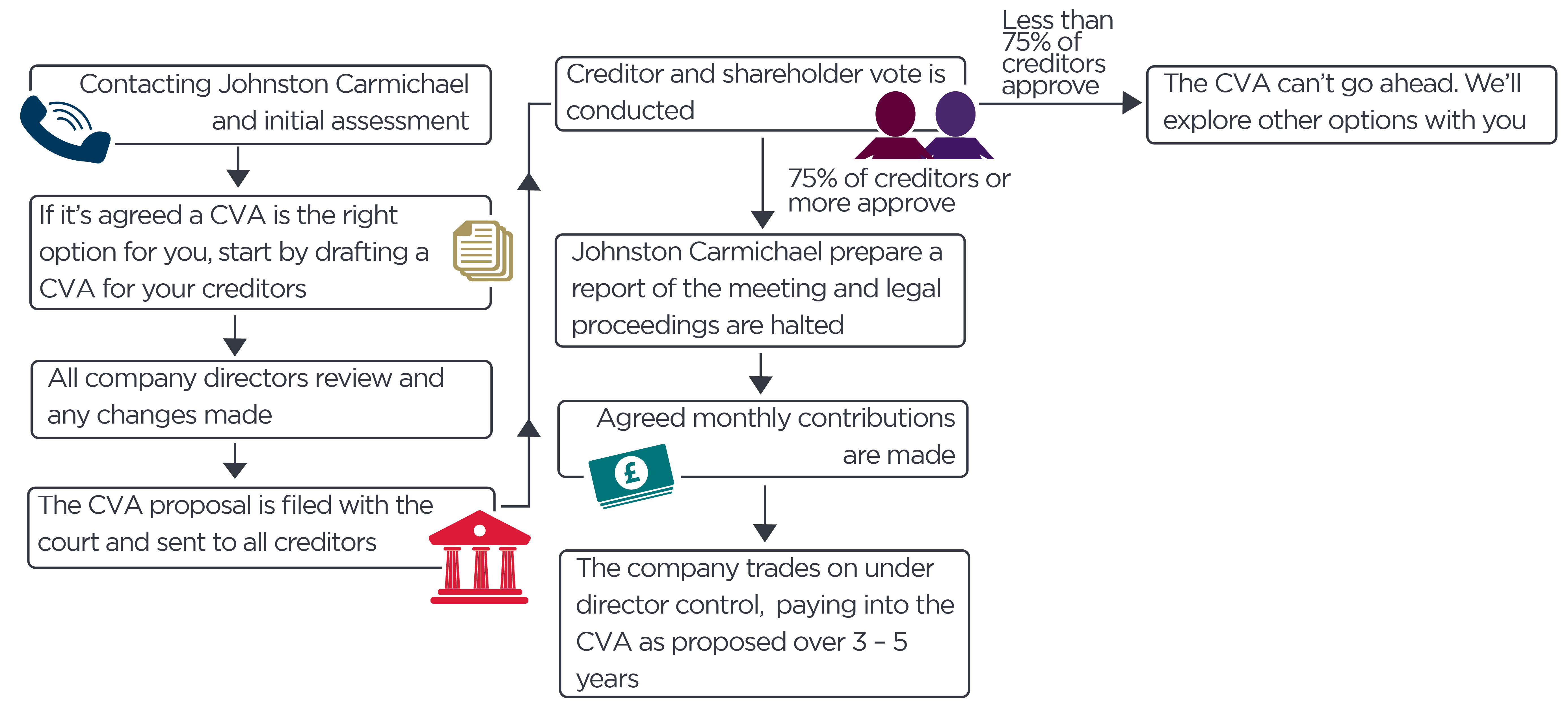

They vary depending on the company and debt owed, but typically a CVA process can last between three to five years. This gives the directors in the company plenty of time to restructure the company, realise assets and return to profitability in an orderly fashion, without creditors forcing it into liquidation.

The steps in the CVA process

The first step is a contacting a licensed Insolvency Practitioner (IP) to act on your behalf. If after reviewing your situation in full it's agreed that a CVA is the best option for your company's situation, a draft CVA proposal for your creditors is drawn up. All of the company directors would then review the CVA proposal and feedback any changes.

The next step is to issue the proposal to your creditors and shareholders. Your appointed IP will coordinate this and creditors will vote on the proposed CVA. If more than 75% of voting creditors approve it, it's approved to go ahead. A formal report is then written up and legal proceedings are stopped. The agreed monthly contributions are commenced or other arrangements that formed part of the proposal e.g. restructuring, asset sales etc.

If your company is small (as defined in the Company Act), it may benefit from a moratorium (a new rule that you can apply to your company to get extra breathing space). This prevents creditors from taking any action before the CVA proposal is approved.

Enquire about a CVA for your business

At Johnston Carmichael our team of Insolvency Practitioners have over 80 years' experience in advising directors of distressed companies. Our aim is to always find the best solution for you and if we can save a company by restructuring, deploying tools like a CVA, that will always be our first aim and objective. If not, looking for the best solution for you and your directors to close down your company is our next step, discharging your duties properly.

Let’s get started

We're here to help. Don't let these worries keep you at night, get in touch and then we'll get started on a plan that's right for you.

Get in touch by completing the short form below and we'll be back in touch shortly, or if you're ready talk now, get in touch with me directly on 0141 222 5800 or by email at Donald.McNaught@jcca.co.uk for an initial chat.

View our other services

Arrange a free consultation with the team now

Have a general enquiry? Get in touch.