Artificial Intelligence: master or servant?

Darren Mascarenhas and Yitongyue Lin (Lilian)

21 September 2023

Little is known about author William Grove, but his two novels – “A Mexican Mystery” (1888) and “The Wreck of the World” (1889) – are notable for their bleak vision of Artificial Intelligence (AI), with robots revolting against their human masters.

That limitless potential was explored further by Hollywood, creating both our wildest dreams and our worst nightmares through movies such as The Terminator, The Matrix, and Minority Report.

But it’s not all about a dystopian future – many of us have gladly welcomed Alexa, Siri, and Google into our lives and homes. So, as we continue to grapple with this gap between fiction and reality, one thing remains certain: AI is with us and it’s here to stay…

The UK Government estimates that business spending on AI could reach £35.6 billion by 2025, which could result in cost reductions exceeding 10% annually. The adoption speed of AI is set to surpass any other major innovation in the last decade with an estimated 1.1 - 1.6 million UK businesses using AI technologies by 2040. The benefits of AI have been well documented, like enhanced processing speeds for large amounts of data and the ability to automate repetitive and tedious tasks. However, there is limited commentary on how to mitigate AI risks and to optimise its effective uses today.

What is AI, and are there different types of AI?

AI refers to the simulation of human intelligence in machines that are programmed to think and perform tasks like problem-solving, machine learning, decision-making, and natural language processing. There are various types of AI that are used today but the two most common ones in a business context are predictive AI and generative AI.

Predictive AI

This utilises historical data and statistical algorithms to make predictions about future events or outcomes. It aims to analyse patterns and trends within the dataset to identify potential future scenarios, patterns or abnormalities and make informed decisions. In the 1980s, predictive AI (under another name) gained significant recognition in the financial services sector as credit scoring models relied on statistical analysis to determine if credit should be granted to its customers. More recently, predictive AI has transformed how the banking industry can carry out risk assessments and fraud checks on customers and their transaction history. This shift has been driven by the maturation of technology and an improved ability to process and interpret data sets. Predictive AI also has the following practical applications:

| Wealth Management | Healthcare | Legal Professional Services |

|---|---|---|

Help advisers better understand their clients' needs, including preferences and attitudes, therefore allowing managers to create unique client personas and personalise the experience of the end user. | Read medical images and patient information to predict early signs of cancer and even diagnose mental disease. Compare patient information and previous cases to offer insights and help make more informed decisions on treatment. | Analyse historical judicial rulings and legal precedents to provide insights on forthcoming cases, even predicting outcomes. |

Generative AI

On the other hand, generative AI focuses on creating new content, rather than making predictions based on existing datasets. Its purpose is to produce innovative and imaginative creations spanning various mediums like images, text, audio, and video that mimic human-like creativity. Recently, generative AI has made headlines with tools like ChatGPT, Bard and DALL-E. During the pandemic, Ogilvy India and Cadbury used generative AI so viewers received versions of its “Not Just a Cadbury” ad that were personalised to their location. This also promoted thousands of local businesses and helped them generate more revenue. Coca-Cola’s latest advertisement uses generative AI to follow a coke bottle as it travels through some of the world’s most iconic paintings and sculptures on its way to a thirsty student in need of inspiration. While the application of generative AI in marketing has garnered criticism for amplifying the potential for misinformation and propaganda, here are some examples of how generative AI is currently employed by:

| Wealth Management | Healthcare | Legal Professional Services |

|---|---|---|

To data -mine information on potential clients from LinkedIn to help relationship managers generate the right messages and tone. | To create synthetic patient data that mimic real patient populations and help drug discovery while not compromising patient privacy. | To quickly produce and enhance legal research and document drafting to help law firms produce high quality output faster. |

The challenge and risks brought by AI

Jessica Rusu, the FCA’s Chief Data, Information, and Intelligence Officer, recently noted that the use of AI in financial services is accelerating with the trend expected to triple in the next three years. Conversations on AI safety among the Bank of England, PRA, and FCA persist, even as the UK has not yet established legal mandates for the ethical integration of AI alongside existing data protection regulations. This leave industries and customers vulnerable to its impact and leaves us with some key challenges that we need to address:

- Magnify bias: AI doesn’t have the ability to identify biases and inherent mistakes therefore its decisions can lead to bias or indirect discrimination. In 2020, the Dutch tax authorities used AI to recognise fraudulent childcare benefit applications, but it erroneously identified approximately 26,000 parents because their profile matched the algorithm-based high-risk radar of low income and “non-western” appearance. These parents were compelled to repay substantial amounts, leading to significant financial and psychological hardships.

- Incomplete decisioning: AI has the potential to create feedback loops if it receives outdated or incomplete data. The FCA Digital Sandbox pilots and the TechSprint programmes have highlighted difficulties that emerging financial firms face when trying to access comprehensive customer information to build the complete picture.

- Lack of data security and transparency: Questions need to be asked about how firms that deploy AI tools are using customer’s data and protecting their privacy. In the UK, the General Data Protection Regulation requires firms to tell customers what information they hold about them and how it is being used. This means that if a firm is going to use AI to process customer’s personal data, they probably need to tell customers about it. But in a world of trying to deliver good customer outcomes and holding firms to higher accountability and responsibility, does this really happen?

Where does your firm sit on the AI maturity scale?

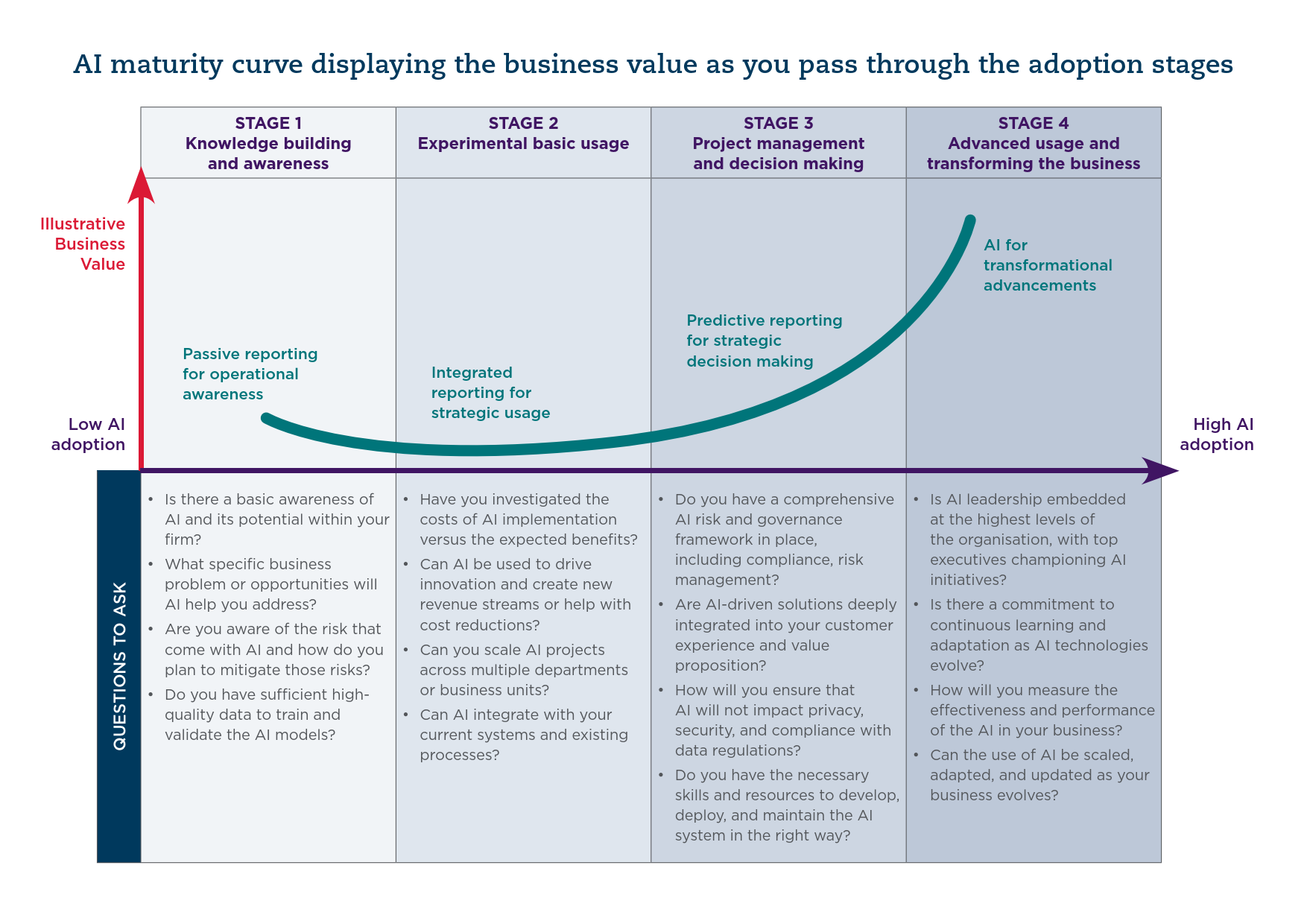

In the UK, the majority of AI adoption across various functions occurs within large-sized companies, whereas medium-sized companies tend to establish their in-house AI capabilities. AI maturity varies considerably amongst firms, with many executives believing that their companies are more data-matured than their competitors, but less are confident in their data security. Financial services firms have a long history and proven examples of using algorithms and high-tech for their BAU activities and decision-making and are far advanced in the curve below. Many non-financial services firms only use AI for operational insights and still have a lot more catching up to do.

To understand where you are and how you can address the increasing non-technical factors in AI adoption by moving up to the next level, below are some key questions that you need to ask yourself along the illustrative AI maturity curve:

Is there more to come?

To put it simply, yes! We may be some way off William Grove’s predictions of a robot rebellion, but AI is here to stay, and we must start planning today to maximise its true potential. If you would like to talk to us about exploring the benefits of AI in your business – like gaining better insights to help redefine strategy, increasing operational efficiency with more automation from a cost perspective or dealing with complex changes – please do not hesitate to get in touch with a member of our Consulting team, or your usual Johnston Carmichael adviser.