As an employer, it's vital to ensure you are up to speed with the latest legislation and adhering to the relevant regulations.

We've broken down everything that you need to know under the following headings:

- Additional bank holiday

- Holiday pay

- Health & Social Care Levy

- Relief for Veteran employment

- Relief for Freeport employment

- Universal Credit & Government Benefits

Additional bank holiday

Due to the coronation of King Charles III, 2023 will have an extra bank holiday which will take place on Monday 8 May 2023. As with the Jubilee, you will need to refer to specific employment contract guidance to determine eligibility - more info can be found in our blog here.

Holiday pay

Due to continued pressure on employers, we remind you of your obligations as an employer and the regulations that you must comply with.

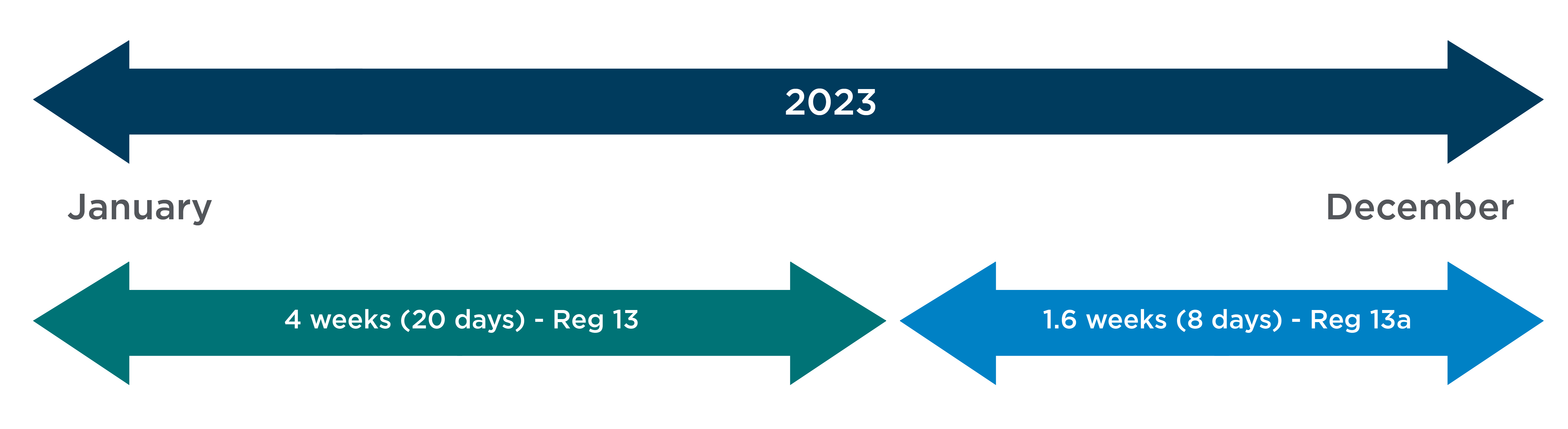

- Regulation 13 – Annual leave

- Regulation 13A – Additional leave

- Regulation 14 – Compensation on termination

- Regulation 15 – When leave may be taken

- Regulation 15A – ‘Accrual’ in first year

Regulation 13 relates to EU rulings and 13A relates to the UK element of your overall 5.6 weeks entitlement for all members of your workforce.

A week's pay can be defined in relation to the Employment Rights Act 1996, which is known as the ERA.

Health & Social Care Levy

The Health and Social Care Levy will no longer go ahead. From 6 November 2022, the temporary 1.25 percentage point increase in National Insurance rates was reversed for the rest of the financial year.

Relief for Veteran employment

Employers can claim National Insurance contributions relief on the earnings of qualifying veterans. A person qualifies as a veteran if they have served at least one day in the regular armed forces. This includes anyone who has completed at least one day of basic training.

The relief is available to all employers of veterans regardless of when the veteran left the regular armed forces, providing they have not previously been employed in a civilian capacity.

Relief will apply on earnings up to the upper secondary threshold. If a veteran’s earnings are above the threshold, employers can apply the relief on the part of the earnings below the threshold. This approach is in line with existing reliefs for under 21s and under 25s apprentices.

Employers can claim relief if they employ a veteran during the qualifying period. The qualifying period starts on the first day of the veteran’s first civilian employment since leaving the regular armed forces and ends 12 months later.

Relief for Freeport employment

This measure introduces a secondary Class 1 National Insurance contributions relief for eligible employers on the earnings of eligible employees working in a Freeport tax site.

Freeports are a special kind of port where normal tax and customs rules do not apply. These can be airports as well as seaports. At a freeport, imports can enter with simplified customs documentation and without paying tariffs. Businesses operating inside designated areas in and around the port can manufacture goods using the imports and add value, before exporting again without ever paying the full tariff on the original goods they imported – although a tariff may be payable on the finished product when it reaches its destination, including if that destination is in the same country outside the freeport. In Great Britain (England, Scotland and Wales), this measure will provide those employers with physical premises in a Freeport tax site (Freeport employers) with a zero rate of secondary Class 1 National Insurance contributions on the earnings of new employees who spend 60% or more of their working time within Freeport tax site. This rate can be applied on the earnings of all new hires up to £25,000 per annum from April 2022 for 36 months per employee.

The UK and Scottish Governments have jointly confirmed that Inverness and Cromarty Firth Green Freeport and Forth Green Freeport have been successful in their bids to establish a new Green Freeport.

Universal Credit & Government Benefits

As a gentle reminder, if operating your own payroll, please ensure that you consider field 43 within your Full Payment Submission (FPS) – this should always include your contractual payment date regardless of when you pay your staff.

If the benefit award period ends near the actual payment date or the regular payment date is moved i.e. Christmas then this could mean that the claimant receives two pay awards within one claim period which could restrict or completely remove their entitlement to Universal Credit.

Please don't hesitate to get in touch If you would like to discuss any of this with a member of our Payroll team.