Johnston Carmichael reports continued growth despite challenging marketplace

17 December 2018

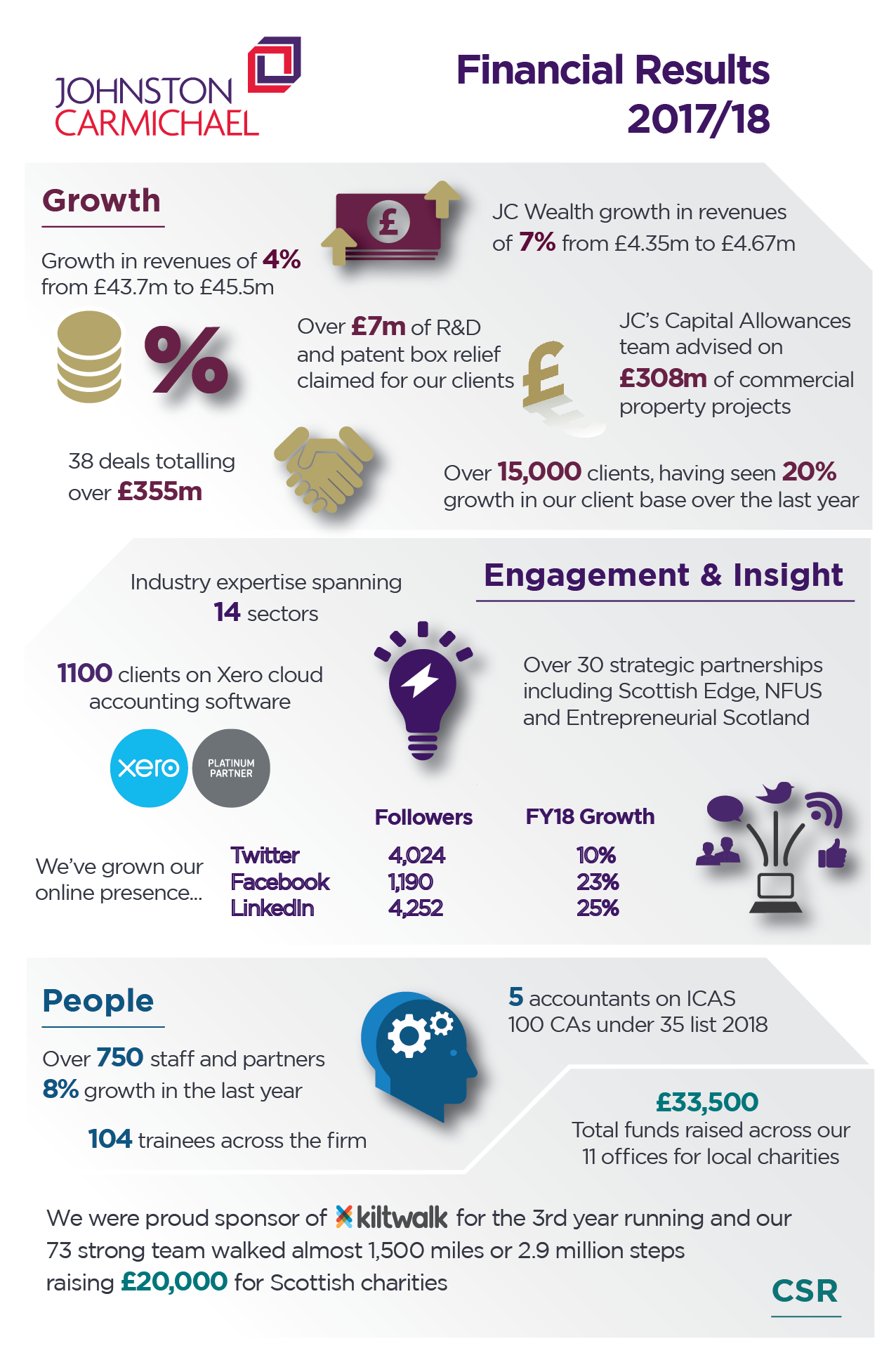

Johnston Carmichael, Scotland’s largest independent firm of chartered accountants and business advisers, has achieved a 4% growth in turnover after generating revenues of £45.5m in the financial year ended 31 May 2018.

The firm, which was founded over 80 years ago and has over 750 staff and partners across 11 locations, said its strong focus on attracting and developing talent had enabled it to grow its market-leading services and pursue new client opportunities.

The financial results posted by the firm saw revenues across the Group grow from £43.7m to £45.5m, with net profit before members’ remuneration declining from £12.2m to £11.8m.

The last year also saw Johnston Carmichael Wealth, the firm’s wealth advisory business, achieve a 7% increase in turnover, seeing growth in revenues from £4.35m to £4.67m.

Chief Executive Sandy Manson said: “We’re encouraged that the firm continues to perform well despite challenges in the marketplace following the downturn in the oil and gas industry.

“Our diversity in sectors, business lines and geographical locations has enabled us to trade robustly and to continue investing in all parts of our business with confidence.

“In the year ahead, we will continue to build an ever-stronger platform from which to grow our business in a sustainable way. This will involve further expanding our range of services and embracing leading edge technologies as we renew and improve our core processes. It will also involve providing our people with a range of exciting career opportunities through supporting their professional and personal development.”

Johnston Carmichael’s tax practice is now one of the biggest in Scotland, comprising a broad spectrum of specialists across a range of areas from international tax, R&D and entrepreneurial taxes, to capital allowances, VAT and Duty and personal taxes. Major hires across the year have included the appointment of a new Head of Employer Services as well as a new Head of VAT and Duty – both key areas of focus for the firm as it helps clients navigate the current landscape as Brexit negotiations continue and the introduction of Making Tax Digital for VAT registered businesses fast approaches in April 2019.

The business has also invested substantially in cutting edge technologies to deliver its services, including the use of data analytics in audit work and cloud technology in its SME-focused offering. The firm is now a Platinum partner for cloud-based accounting software Xero, recognising the key role it is playing in supporting Scotland’s SMEs to embrace the digital era.

The business also continues to grow its international work through its membership of PKF – a family of legally independent member firms operating in 150 countries – hosting a major conference at the end of last year in Edinburgh on international tax.

Sandy Manson added: “Our ambition remains firmly focused on growing our existing position of being Scotland’s largest independent firm and we will do that by continuing to provide outstanding service to our clients through a motivated and talented team of professionals.”

Despite the challenges of Brexit, market volatility and investment requirements, we remain very positive and excited about the prospects for our people and the business

Sandy Manson

Chief Executive