The importance of cash flow modelling for Medical & Healthcare professionals

Valerie Wilson

Chartered Financial Planner

29 September 2021

As a Medical & Healthcare professional it can be difficult to envisage what your income, expenditure and goals look like in reality.

This is where we can use a cashflow model tool to give you a visual representation of your financial goals and objectives.

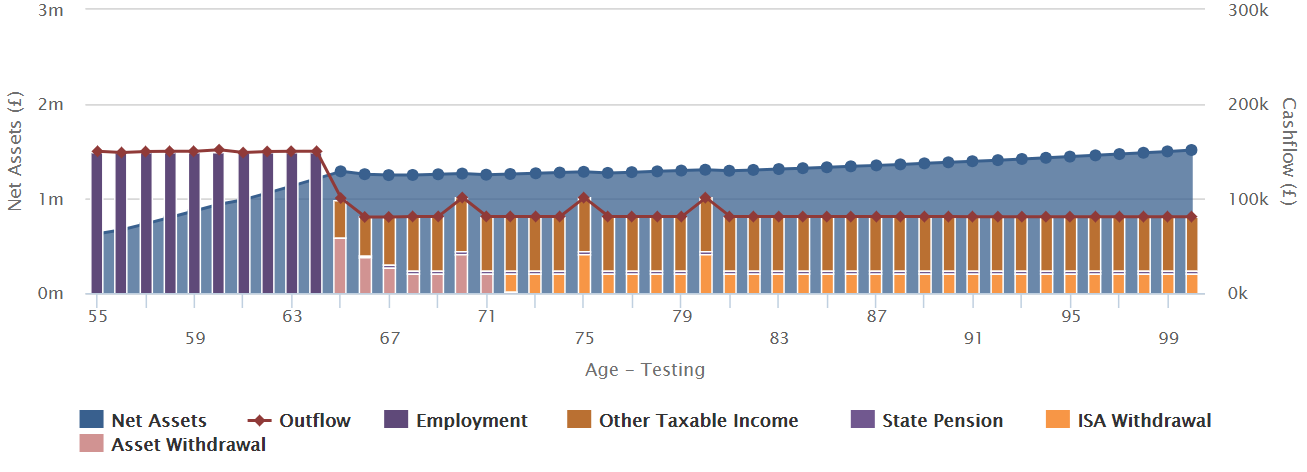

The example graph below displays how a range of different income streams can help you to achieve your financial goals during your career and in retirement.

What are my Income Streams?

If you look at the graph above, you can see that in your early years your net assets are rising steadily. When you reach retirement, you become reliant upon your pensions and other assets to fund your expenditure. The graph highlights how much of your expenditure is then covered by your guaranteed State Pension, and NHS Pension (listed as other taxable income in the graph) - therefore allowing you to put a plan in place for additional outgoings, to live life on your terms.

How will this benefit Medical & Healthcare professionals?

Due to the nature of the Medical & Healthcare profession’s extended education and training, typical big life events such as home purchase can happen later in life. This can lead to a large mortgage debt and schooling and university costs for children can typically carry on until your late 50s. Cashflow modelling shows the potential longevity of your existing assets and where you will derive income from in retirement.

Given that a large proportion of income for retiring medical professionals will be covered by your NHS Pension, it is possible to show which assets could be considered ’surplus’ in a cashflow model. This opens up a wide avenue of intergenerational planning options, allowing assets to flow to younger generations whilst mitigating unnecessary tax.

Protection – If something happens to me will my family be okay?

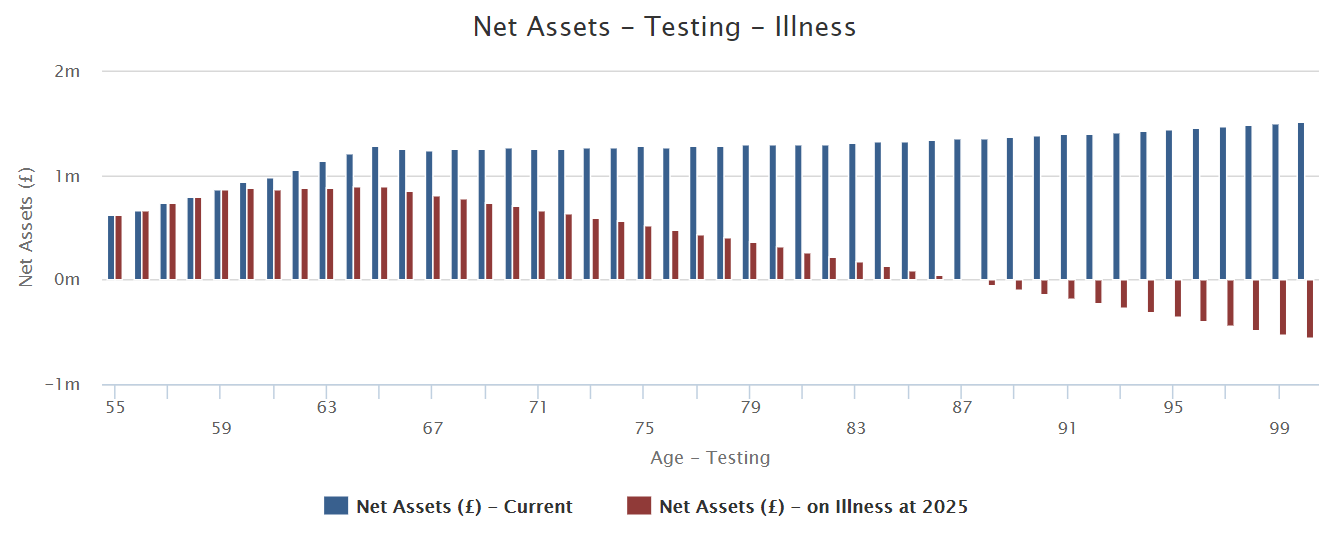

If you were to suffer a long-term illness, your income may be covered by sick pay for the first 12 months, but what happens thereafter? An earlier blog, talks about this in more detail, and as you can see from the chart below, the loss of income with no insurance can have a drastic impact upon your assets over time.

Assets without Insurance Policy implemented

Using cashflow modelling, we can work with you to understand what income level or lump sum you and your family may require if you were to be signed off with a long-term illness. In addition, we can show you what impact any premiums may have on your affordability going forward. The above chart shows a rather distressing scenario where the main breadwinner in the family falls ill or passes away and as you can see, the impact on your net assets position is sizeable.

What does this look like in practice?

You may recall from our previous blog on this topic, that the NHS sick pay benefits are fairly generous, however these are only in operation to a point.

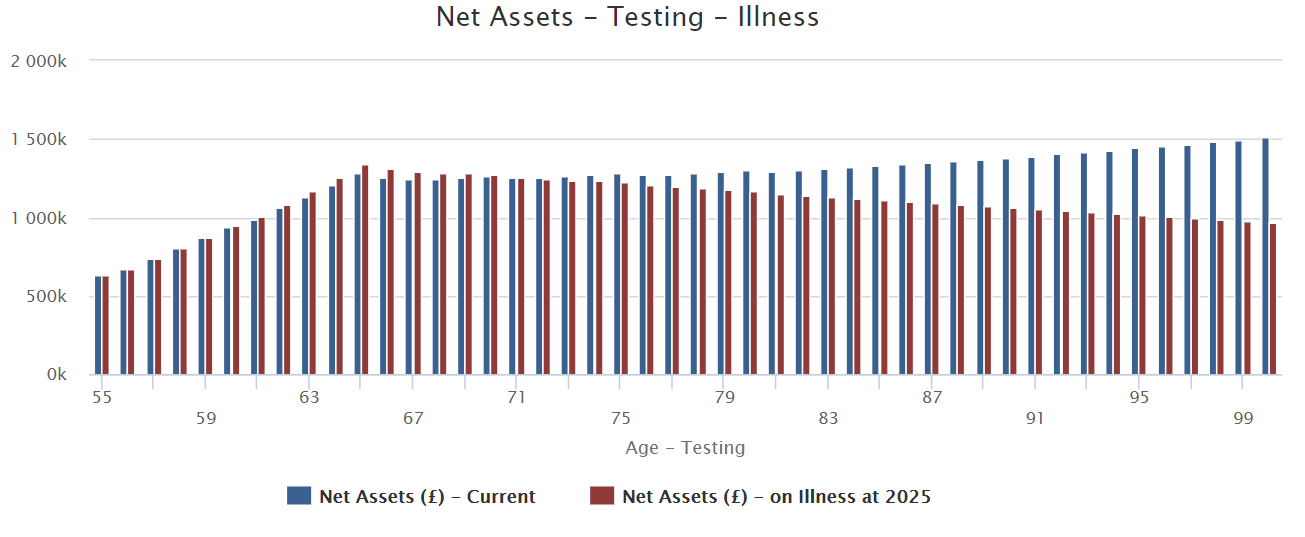

Implementation of an Income Protection Policy

Assuming you were never able to work again, the implementation of an income protection policy has a dramatic effect on the longevity of your overall assets, as can be seen in the chart above.

This gives you peace of mind that in the event of a long-term illness, you and your family will be looked after moving forward.

The same exercise can be undertaken for Life and Critical Illness insurance, ensuring that any lump sum that is received will be sufficient, not only to pay off any outstanding debts, but to cover living costs and overall, provide financial security for those you leave behind.

Financial Goals

Having a financial plan ahead of time will allow you to forecast the expensive events in life, (particularly if you have children), such as schooling, university, weddings, a first car or house deposit, and understand what you will need to save in order to make these goals financially viable.

The average cost of these life events is as follows:

- Private school secondary education - £106,000 (source: The National News)

- University accommodation - £15-20,000 (source: The Guardian)

- First car - £5,000 (source: Go Compare)

- House deposit - £57,000 (source: Statista)

Having these goals laid out early in your financial plan can allow you to answer the key question; can I afford to achieve all of my goals?

Achieving your financial objectives takes planning. Very rarely would you move forward into a new venture without a plan to underpin it, therefore you and your family’s finances should be no different. Building a financial plan should be an essential starting point for how you want the rest of your life to look, and more importantly, how to implement it.

Building a financial plan is a good starting point, however, adjusting it year on year to move with life’s changes is even more important. Sadly, nothing travels in a perfect straight line.

If you would like to discuss your cashflow, please do not hesitate to contact myself, a member of our Wealth team, or your usual Johnston Carmichael adviser.

Disclaimer: Johnston Carmichael Wealth Limited is authorised and regulated by the Financial Conduct Authority.

This communication should not be read or considered as financial advice. While all possible care is taken in the preparation of this communication, no responsibility for loss occasioned by any person acting or refraining from acting as a result of the information contained herein can be accepted by this firm.