Outcome of NHS pension consultation - key changes to be aware of

10 February 2021

Last year, the Government undertook a consultation to review proposed changes to all of the main public service pension schemes, including NHS pensions.

The consultation has now closed and the Government has announced the outcomes, which will bring about some important changes to NHS pension schemes.

Will I be affected by the changes?

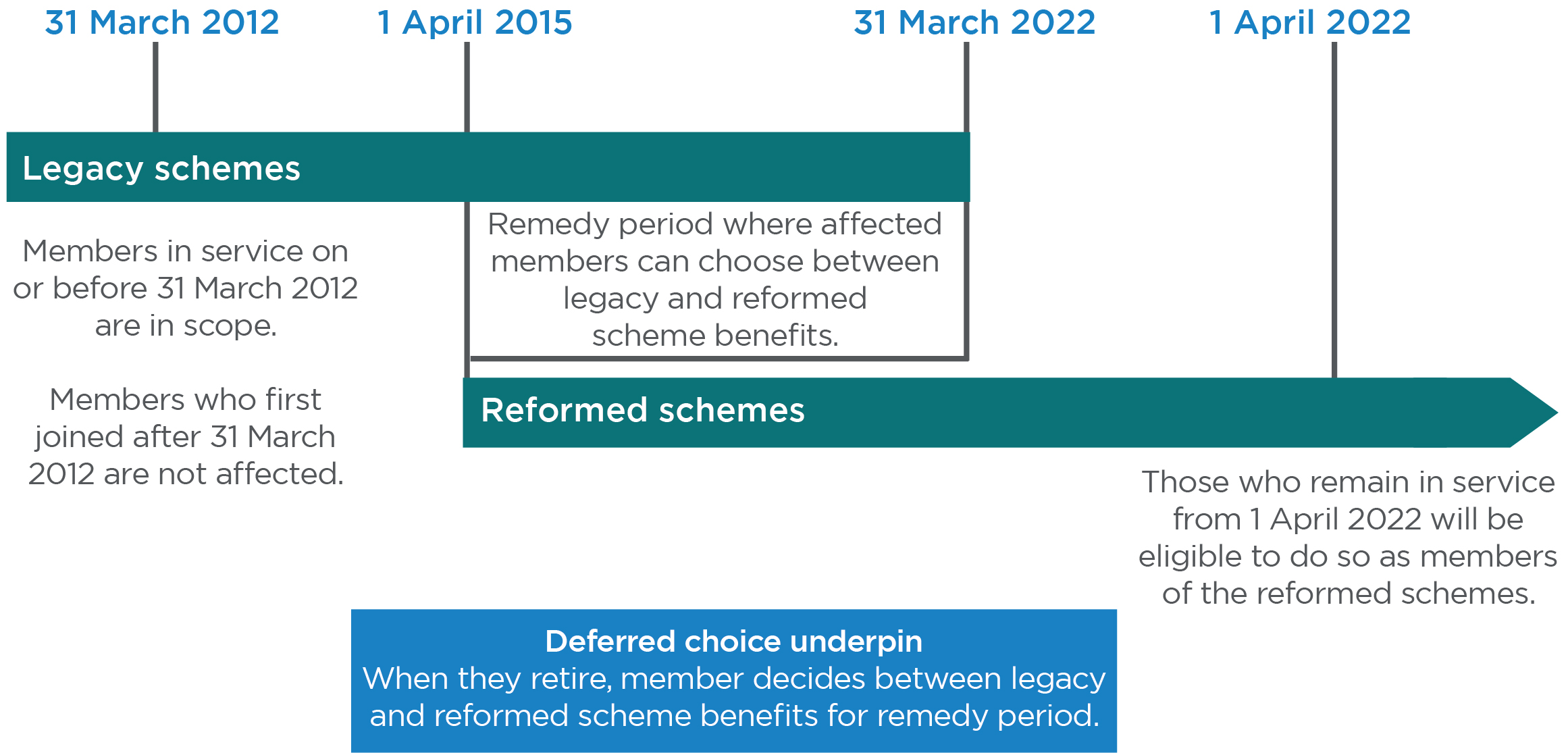

You will be affected by the changes if you joined a public service pension scheme on or before 31 March 2012, and were still a member of the scheme on 1 April 2015. This includes members who are currently active, deferred or retired.

You may also be affected if you have received a spouse's or dependant's pension since 2015, if the spouse or dependant joined a public service pension scheme on or before 31 March 2012 and was still a member on 1 April 2015.

In 2015, public service pension schemes were subject to reform which introduced new schemes for service from 2015 onwards. The new schemes provide pension benefits based on average earnings throughout the individual's career, rather than their final salary. The new schemes also link 'normal pension age' to State Pension age in most cases.

These reforms did not apply to pension scheme members who, as of 31 December 2012, were within 10 years of their normal pension age. In addition, members who missed out on this protection were given a form of it on a tapered benefit. Those who were between 10 years and 13 years and five months of their normal retirement date on 31 March 2012, their move to the new scheme was delayed on a tapered basis, ranging from periods from a few months to a number of years with a 'transitional protection'.

In 2018 however, this was judged to be discriminatory against younger pension scheme members by the Court of Appeal, so the Government opened a consultation on its proposals to remove this discrimination.

The Government proposed asking those affected, as defined above, to choose which set of pension scheme benefits they would like to receive for the 'remedy period' (1 April 2015 to 31 March 2022) - benefits from the original, 1995 or 2008 section of the scheme (the legacy scheme), or opting for their service to count towards the new 2015 scheme (the reformed scheme). The consultation also requested responses on when this decision should be made.

What's changed?

The Government has now announced that the majority of responses to the consultation backed the introduction of a ‘deferred choice underpin’ (DCU) as the way to remedy the discrimination. This means that eligible members will be able to choose at the point of retirement whether the legacy or reformed schemes would be better for them for the period between 1 April 2015 and 31 March 2022.

This result reflects the fact that pension members who are still some time away from retirement may not be in a position to accurately predict which scheme will be most suitable for them in the future, as well as ensuring members do not have to make any significant immediate decisions in the midst of the ongoing coronavirus pandemic.

All affected pension scheme members will be able to choose to receive benefits from the relevant legacy scheme or to instead receive the benefits that would have been available from the relevant reformed scheme, for any period of service between 1 April 2015 and 31 March 2022. It is an either/or choice - you cannot select benefits from both schemes.

The consultation response also confirmed that the legacy scheme will close on 31 March 2022. From 1 April 2022, anyone who remains in service will do so as a member of their respective reformed scheme.

An overview of the pension reform process

What if I have previously made a decision based on the 2015 reforms?

While the move to a deferred choice model was deemed the most suitable option for members, those who have already taken action as a result of the age discrimination introduced by the reforms in 2015 could be concerned. Decisions such as taking early retirement, cancelling added years contracts, deciding to work part-time, or opting out of the pension scheme altogether, could have had a knock-on effect on their pension entitlements.

In terms of rectifying the effect these decisions may have had, the Government has said that this will be assessed on a case-by-case basis. Members will be required to provide proof that their decisions were made as a result of the discrimination.

What action do I need to take now?

If you are affected, you will not be asked to make a decision on which benefits scheme you wish to select until you are at the point of retirement.

If you are nearing retirement, you should consider which benefits would be most appropriate for you to receive for the remedy period - your original pension scheme benefits, or the new 2015 scheme benefits.

Get in touch

The decisions which may need to be made as a result of these changes will be dependent on your individual circumstances and there may be a number of complex factors to take into account. With a clear understanding of both the healthcare profession and your personal circumstances, our expert team of trusted advisers and financial planners can discuss with you the possible outcomes of each of your options and help you make the best decision when the time comes.

If you would like more information or to arrange a chat, please don't hesitate to get in touch with me or your usual Johnston Carmichael adviser.