The Chancellor announced the Coronavirus Job Retention Scheme (CJRS) on Friday 20 March with the aim to protect jobs during the crisis.

This page gives an overview of the first phase of the Coronavirus Job Retention Scheme which is live until 30 June 2020. After this time, phase two of the Coronavirus Job Retention Scheme will be in place.

Latest updates to be aware of:

- The Job Retention Scheme has been extended and will now run until 31 October 2020 - read our latest blog for full details.

- A recent enhancement to the scheme means working parents on statutory maternity and paternity leave, who are returning to work before October 2020, will be eligible - read our latest blog for full details.

- The Government has announced that the eligibility cut-off date for the scheme will be extended from the original 28 February 2020 to 19 March 2020.

The Portal is now open - claims can made through the portal using your business PAYE login details (also known as your Government Gateway login) and it is anticipated that money is to be paid within six working days of application.

How it could work in practice

Based on the further guidance published on 27 March, we've created worked examples of how the Coronavirus Job Retention Scheme could work in practice: visit our Coronavirus Job Retention Scheme in practice page here.

General overview and FAQs

We have received many questions from our clients about how the scheme will work, and importantly, how quickly they can access it to provide the vital cash flow needed to pay their employees’ salaries. With this in mind we have produced a guide based on the most up to date information available and have sought to apply our best interpretation on the key elements of the scheme on that limited information. We will update this guide as further details emerge.

Please contact our team of experts at JRS@jcca.co.uk for more information.

Use the quick links below to navigate to the areas of interest to you.

Key areas covered in this guide:

- Summary and scope of the scheme

- Who is eligible?

- What qualifies as being on payroll as at 19 March 2020?

- How do I furlough employees?

- Applying for the grant

- Calculating the grant

- What are qualifying earnings?

- What do employees get paid

- Payroll processing considerations

- Holiday pay

- Other considerations

- Working examples

- Funding payroll costs in the meantime

- FAQs

Summary and scope of the scheme

The guidance on where the scheme can apply has changed since it was first introduced. The initial guidance stated that employers could use the scheme to cover employees who would be made redundant because of the coronavirus crisis. The updated guidance now states that the scheme is designed to help employers whose operations have been severely affected by the coronavirus to retain their employees and protect the UK economy.

This is arguably drawn wider than the initial guidance but it would suggest that employers should take steps to document how and to what extent they have been impacted.

The scheme will be backdated to 1 March 2020 and will run for until 31 October 2020 (it was initially until 30 May but the Government announced an extension on Friday 17 April). It applies to all UK organisations with employees, provided they had created and started a PAYE payroll scheme on or before 19 March 2020. Eligible employees are those employees who were on the organisation’s payroll as at 19 March 2020 (originally it was 28 February, but the Government extended the cut-off to 19 March, on Wednesday 15 April). and covers all types of contracts. Furloughed workers cannot undertake work for the employer whilst on furlough leave and the minimum furlough leave is three weeks.

The government will provide a grant of the lower of 80% of the employee’s regular wage or £2,500 per month plus associated employer NI and auto enrolment pension contributions on the subsidised salary. Employers can choose to pay the additional 20% top up (or indeed the gap to the full salary if desired) or they can choose not to, subject to agreeing this with the employee in accordance with general employment law.

Employers will need to firstly designate workers as furloughed and HMRC will launch a new portal into which the employer will need to upload certain information that will then trigger the payments from HMRC. The government are anticipating that the portal will be operational by the end of April. Employers can only submit one claim every three weeks. We anticipate that all employers must have a government gateway account in order to lodge the claim.

The furloughed payment plus any top-up will be processed via PAYE and subject to tax and NI as normal. HMRC have expressly stated that they retain the right to retrospectively audit all aspects of claims.

Return to the main contents at the top of the page

Who is eligible?

Employers

Any UK organisation with employees can apply, including:

- Businesses;

- Charities;

- Recruitment agencies (agency workers paid through PAYE); and,

- Public authorities.

The organisation must have created and started a PAYE payroll scheme on or before 19 March 2020 and have a UK bank account. Where a company is being taken under the management of an administrator, the administrator will be able to access the Job Retention Scheme.

Employees

The updated guidance has provided clarity in most respects but there are still questions in some areas that we have highlighted in this section.

Furloughed employees must have been on the PAYE payroll on 19 March 2020, and can be on any type of contract, including:

- Full-time employees

- Part-time employees

- Employees on agency contracts

- Employees on flexible or zero-hour contracts

The following people can also be furloughed.

Employees with caring responsibilities

Employees who are unable to work because they have caring responsibilities resulting from the coronavirus crisis can be furloughed. For example, employees that need to look after children can be furloughed.

Fixed-term contracts

It has been clarified that a fixed-term contract can be renewed or extended during the furlough period without breaking the terms of the scheme. Where a fixed-term employee’s contract ends because it is not renewed or extended, then the ability to claim the grant will end on the date of contract terminating. It will therefore be important to review dates of fixed-term contracts and ensure they are renewed or extended if the employer wishes to continue to benefit from a grant.

Eligible individuals who are not employees

As well as employees, it has now been clarified that the grant can be claimed for the following if paid via PAYE:

- Office holders including company directors (see note below)

- Salaried members of LLPs

- Agency workers including those employed by umbrella companies

- Limb (b) workers

Company directors

It has been confirmed that company directors, including individuals who are directors of their own personal service companies, can be furloughed. The board should properly record this in a formal minute and in writing to the director concerned. This is an important point for shareholding directors of their own limited companies. The decision and communication must be dealt with formally.

As expected, company directors can carry out duties necessary to fulfil their statutory obligations, provided ‘they do no more than would reasonably be judged for that purpose, for instance, they should not do work of a kind they would carry out in normal circumstances to generate revenue or provide services to or on behalf of their company’.

Every circumstance needs to be considered on its own merits but it is clear that directors should expect some future scrutiny of their activities over the furlough period and may be asked to provide evidence through, for example, email and social media accounts.

If you made employees redundant or they stopped working for you after 28 February

If you made employees redundant, or they stopped working for you on or after 28 February 2020, you can re-employ them, put them on furlough and claim for their wages through the scheme. This applies to employees that were made redundant or stopped working for you after 28 February, even if you do not re-employ them until after 19 March. This applies as long as the employee was on your payroll as at 28 February and had been notified to HMRC on an RTI submission on or before 28 February 2020. This means an RTI submission notifying payment in respect of that employee to HMRC must have been made on or before 28 February 2020

If an employee has had multiple employers over the past year, has only worked for one of them at any one time, and is being furloughed by their current employer, their former employer/s should not re-employ them, put them on furlough and claim for their wages through the scheme.

Return to the main contents at the top of the page.

What qualifies as being on payroll as at 19 March 2020?

Some employees may not have been paid in February because, for example, they are a seasonal worker. Whether they were processed as a nil payment or suspended from the payroll run will be determined by how the employer processed the payroll in their software. Our understanding is that as long as a P45 was not issued for the individual in question then they will be eligible for the scheme. Please note that you will need to be mindful of current legislation around irregular payments. If an individual is paid irregularly, but is always paid at least once every three months, or is reported on each regular FPS, then you do not need to set the irregular payment indicator.

If your employee is paid on an irregular basis and is unlikely to be reported on an FPS for three months or more, you need to set the irregular payment indicator to ‘Yes’ on the Full Payment Summary (FPS).

Return to the main contents at the top of the page.

How do I furlough employees?

It is unlikely in most instances that employers will have the contractual right to withdraw work. Therefore, the employer will need to get the agreement of the proposed furloughed employees to allow them to change their status. The employer can ask all of the staff to indicate whether they would accept being furloughed and/or can ask for volunteers. Once an employee has confirmed they are agreeable to the change in status, the employer should designate them as furloughed and duly notify them in writing of the change. To be eligible for the grant, employers must confirm in writing to their employee that they have been furloughed and a record of this communication must be kept for five years. This is fairly certain to be a review point for HMRC on subsequent audit of claims and is an important compliance point that employers must not miss.

It is expected that most employees in the current situation will be agreeable to the change, given that the alternative may well be redundancy and the employer should make it clear that commencing a redundancy process may be the alternative approach. However, the employer should not present furloughed leave as an ultimatum.

It has been confirmed that an employee can be furloughed multiple times, subject to each separate instance being for a minimum period of three weeks. This will afford employers some flexibility by allowing rotation and matching the resource with demand.

Where a business is looking to cease all operations and furlough all employees, the risks of inadvertently discriminating against an individual or a group of employees will be lessened. Where a business is continuing operations, there will be greater risks because some employees may be happy to be furloughed (e.g. those with children and those who will only lose 20% of their pay) whilst others may want to continue working such as higher paid workers who will potentially lose a lot more of their pay.

Assuming that employees are agreeable, the other primary concern will be the level of the salary payment. Where the wage of an employee is less than £3,125 per month, the government grant will be 80% of the salary. The employer can choose to pay the 20% as a top up but is not obliged to do so. However, as this is a contractual change, the employer should agree this with the employee as part of the process of designating them as a furloughed worker. Where the employment costs are greater than £3,125 per month, the government grant will be the cap of £2,500 per employee. As with the previous example, the agreement of the employee should be obtained to whatever is being proposed.

Employers should take advice from their in-house or external employment law advisers to ensure compliance in this fast-moving area. Consideration of contracts, consultation and fair selection processes will all be important as will trying to reach agreement with employees to avoid problems down the line. We have seen several examples of template letters that employers are using to deal with these points.

The minimum furlough leave period is 3 weeks. There is nothing in the guidance to suggest that an employee cannot be furloughed more than once in the period of the scheme and indeed most commentators are of the view that this will be possible. This may be useful to allow employers to flex capacity to meet the fluctuating demand for services whilst being fair to all staff by applying furlough leave on a rotational basis.

Return to the main contents at the top of the page.

Applying for the grant

The grant is not automatically awarded. It must be applied for. HMRC will launch a new portal into which employers will be able to submit their claims. Claims can be backdated to 1 March 2020. The employer must calculate the amount they are claiming. It is not known whether this will be a global total or per furloughed employee so employers will need to have run calculations to facilitate both scenarios. Our payroll team can assist with this.

Only one claim can be submitted every three weeks which is the minimum furlough period. It has been confirmed that an employee can be furloughed multiple times, subject to each separate instance being for a minimum period of three weeks. This will afford employers some flexibility by allowing rotation and matching the resource with demand. The first claim will cover the period from the later of 1 March 2020 and date of furlough leave commencing.

The information needed for the portal will include:

- PAYE reference number

- the number of employees being furloughed

- the claim period (start and end date)

- amount claimed (per the minimum length of furloughing of three weeks)

- company bank account number and sort code

- contact name

- phone number

We are seeking clarity on whether active HMRC online services accounts will be required. To prepare, employers should take steps now to ensure they have a valid online account with confirmed login details (you may know this as your Government Gateway account). You can register for an account on the Government's website.

It will likely be several weeks before payments are made by HMRC. HMRC will make BACS payments to the organisation’s bank account.

We are establishing a team to be able to assist clients with the preparation and submission of claims. Please note that if a login is required, we will need the these details from the employer.

Return to the main contents at the top of the page.

Calculating the grant

The grant will be made up of two parts as follows:

- The lower of 80% of an employee’s regular pay or £2,500 per month; plus

- The associated Employer NIC and minimum automatic enrolment employer pension contributions on the subsidised wage per point1.

It has been clarified that the grant will be pro-rated if an employee is only furloughed for part of a pay period.

An example would be where an employee is furloughed from 16 March - the March grant (before employer NI and pension) will be the lower of:

- 80% of their salary for a 2 week period;

- £1,250.

The employee would be entitled to receive their salary in full for the first two weeks in March.

It has also been clarified that furlough leave can start from the date that the employee ceases work, not when the decision was made or when the employer wrote to them to confirm their furloughed status. This means that employees who ceased working in early March before the Chancellor’s announcement of the scheme, can be furloughed from the date they ceased working.

Basis of pay calculation – salaried employees

For full-time/part-time salaried employees, the employee’s actual salary before tax, as of 19 March 2020, should be used to calculate part 1. Fees, commission and bonuses should not be included for salaried employees.

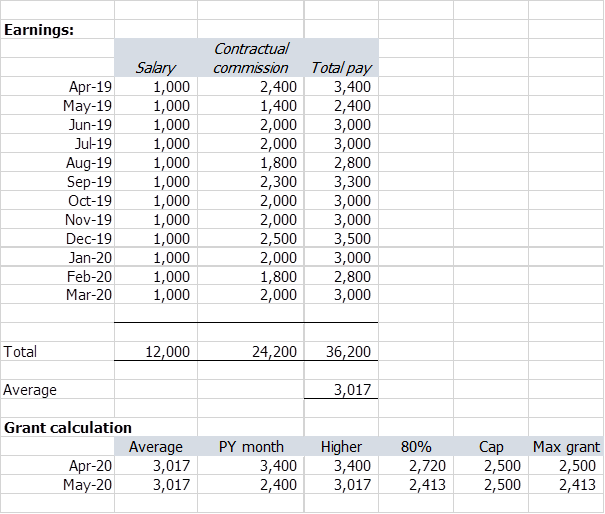

Basis of pay calculation – where an employee’s pay varies

If the employee has been employed (or engaged by an employment business) for a full twelve months prior to the claim, you can claim for the higher of either:

- the same month’s earning from the previous year (i.e. March 2019 for March 2020, April 2019 for April 2020 and so on);average monthly earnings from the 2019-20 tax year

- If the employee has been employed for less than a year, you can claim for an average of their monthly earnings since they started work. If the employee only started in February 2020, use a pro-rata for their earnings so far to claim

Basis of pay calculation - compulsory v discretionary payments

The updated guidance states that an employer can claim for any regular payments that they are obliged to pay their employees. This includes wages, past overtime, fees and compulsory commission payments. It then goes on to say that discretionary bonuses (including tips), commission payments and non-cash payments should be excluded. This means that troncmaster schemes will not be covered under the scheme.

Our reading of this is that ‘compulsory’ should be read as ‘contractual’. Given that some employees rely heavily on the commission part of their pay, we assume from the revised guidance that employees who are contractually entitled to commission can be treated as “Employees whose pay varies” and, as such, that their average pay can be used to calculate the amount due to be paid (and recoverable) under the Scheme, however, further clarification of this point from HMRC would be helpful.

We have included the following example based on our understanding:

Basis of pay calculation - benefits in kind and salary sacrifice schemes

The updated guidance makes it clear that the cost of non-monetary benefits cannot be included in the wage being claimed for. It also clarifies that the reference salary that is used should be after any salary sacrifice.

It then goes on to say that HMRC has agreed that the coronavirus crisis will count as a life event that could, depending on the terms of the salary sacrifice arrangement, warrant a change to a salary sacrifice arrangement. This would allow employees whose pay is reduced, to reduce their salary sacrificed so as to benefit from an improved take home pay. It will be important to take advice and fully document any change that is implemented.

Please note: we are aware the government employee guidance doesn't refer to the 2019-20 tax year for the purpose of the calculation and suggests a rolling twelve month period. We are seeking clarification on this.

Weekly and four weekly paid workers

The total maximum grant amount that can be claimed by an employer per employee will be £2,500 per month plus the associated Employers’ NIC and minimum automatic employer contributions (for weekly paid workers, this cap equates to £576.92 and for four-weekly paid workers, the cap equates to £2,307.69).

Return to the main contents at the top of the page.

What are qualifying earnings?

Qualifying earnings is the name given to a band of earnings that you can use to calculate contributions for auto enrolment. For the 2019/20 tax year this is between £6,136 and £50,000 a year. The figures are reviewed every year by the government.

Return to the main contents at the top of the page.

What do employees get paid?

As a minimum the employer must pay the element of the grant that is the subsidised salary to the employee as a salary. That will be the lower of 80% of their wage as per above or £2,500 per month. The Employer can choose to top-up but is not obliged to do so. As this will be a contractual change, the employee must agree to any change in their wages. If the subsidised salary is below National Living Wage (NLW)/National Minimum Wage (NMW), the employer is still not required to top-up because the employee is not working. However, if the employee is required to undertake an online training course whilst on furlough leave, they must be paid at least NLW/NMW for that.

The furloughed payment will be subject to the usual deductions as normal including income tax, national insurance, student loan, pension contributions and any wage arrestments in place.

Return to the main contents at the top of the page.

Payroll processing considerations

The processing of payroll could become exceptionally complicated for furloughed employees. The employee may have sacrificed salary for other benefits such as pension and childcare vouchers. As their take home pay may well reduce during furlough leave, they may want to ‘suspend’ their salary sacrifice. Employers should take great care because it will come down to the details of the salary employer’s sacrifice scheme as to whether and how this is done.

HMRC has agreed that the coronavirus crisis will count as a life event that could, depending on the terms of the salary sacrifice arrangement, warrant a change to a salary sacrifice arrangement. This would allow employees whose pay is reduced, to reduce their salary sacrificed so as to benefit from an improved take home pay. It will be important to take advice and fully document any change that is implemented.

We have included some examples below of how the payroll and grant will interact and our payroll team are on hand to support you at this time. Please contact Michael McAllister.

Return to the main contents at the top of the page.

Holiday Pay

Employers have the right to tell employees and workers when to take holiday if they need to. An employer could, for example, shut for a week and tell everyone to use their holiday entitlement. In most situations, employees and workers should use their paid holiday (‘statutory annual leave’) in their current leave year. This is 5.6 weeks in the UK.

This is important because taking holiday helps people:

- get enough rest

- keep healthy (physically and mentally)

During the coronavirus outbreak, it may not be possible for staff to take all their holiday entitlement. They may be getting to the end of their leave year with holiday still left to take.

Carry Over

The government has introduced a temporary new law to deal with coronavirus disruption. Employees and workers can carry over up to 4 weeks’ paid holiday over a 2-year period, if they cannot take holiday due to coronavirus.

For example, this could be because:

- they’re self-isolating or are too sick to take holiday before the end of their leave year

- they’ve been temporarily sent home as there’s no work (‘laid off’ or ‘put on furlough’)

- they’ve had to continue working and could not take paid holiday

Some employers will already have an agreement to carry over paid holiday. This law does not affect any agreements already in place. If an employee or worker leaves their job or is dismissed during the two-year period, any untaken paid holiday must be added to their final pay (‘paid in lieu’).

If someone is temporarily sent home because there’s no work

If someone is temporarily sent home because there’s no work they’ll continue to build up (‘accrue’) holiday in the usual way.

Agreeing how extra holiday is carried over

If employers do not already have an agreement in place, they can decide whether they’ll allow extra holiday (more than the 4 weeks’ paid holiday) to be carried over. Extra holiday may include:

- the remaining 1.6 weeks of statutory annual leave

- holiday that’s more than the legal minimum

Employees and workers should check their employment contract or talk to their employer to find out what they’re entitled to.

Reaching an agreement

If the workplace has a recognised trade union, or there are employee representatives who work with the employer on these matters, the employer should involve them in agreeing changes. If any agreement is made, it’s a good idea for it to be in writing.

Employers should get legal advice if they’re not sure whether to allow extra holiday to be carried over.

Previously booked holidays

If an employee no longer wants to take time off they'd previously booked, for example because their holiday's been cancelled, their employer may still tell them to take the time off. If the employee wants to change when they take this time off, they'll need to get agreement from their employer.

Using holiday for a temporary workplace closure

Employers have the right to tell employees and workers when to take holiday if they need to. An employer could, for example, shut for a week and tell everyone to use their holiday entitlement. If the employer decides to do this, they must tell staff at least twice as many days before as the amount of days they need people to take.

For example, if they want to close for 5 days, they should tell everyone at least 10 days before. This could affect holiday staff have already booked or planned. So employers should:

- explain clearly why they need to close

- try and resolve anyone's worries about how it will affect their holiday entitlement or plans

Return to the main contents at the top of the page.

Other considerations

When the scheme ends, the employer must make a decision as to whether employees can return to work. If the circumstances are such that it is not possible, the employer can consider redundancies but must follow due process. Advice on this area will be important from a legal expert.

Employees that have been furloughed have the same rights as they did previously. This includes continuity of employment, Statutory Sick Pay entitlement, maternity rights, other parental rights, rights against unfair dismissal and to redundancy payments.

Return to the main contents at the top of the page.

Working examples

To help illustrate the scheme applied in practice, we have provided some working examples here.

Return to the main contents at the top of the page.

Funding Payroll Costs in the meantime

Given that the Government have said that the scheme may not be fully operational until the end of April, an important consideration for employers whose cash flow has been worst affected by the situation is how to fund payroll costs in the meantime. Should the employer not have sufficient funds available then employers should consider approaching their bank to see if they are willing to provide short-term bridging finance, perhaps as part of the CBIL scheme that is covered elsewhere in our guidance.

It is unclear whether the scheme will allow an employer to receive the 80% reimbursement once their payroll is actually processed but prior to the employer actually paying the net amount due to the employee. For cash strapped employers this point needs to be clarified but it may well not be possible.

Return to the main contents at the top of the page.

Frequently Asked Questions

We continue to receive many questions. Here are some answers to those most commonly asked:

1. Can a furloughed employee temporarily opt-out of auto-enrolment?

An employee who is furloughed may well see a reduction in their take home pay. Where an employee has previously earned more than £3,125 per month, that reduction may be significant. Under normal rules an employee can choose to opt out of auto-enrolment by notifying the employer and from that point there will be no employee or pension payment. They could then choose to opt back in after the end of their furloughed period. Please note that an employer should in no way encourage an employee to opt out.

Some pension schemes may also offer payment holidays. Employees will need to look at specific scheme rules.

2. Can the scheme be used for fixed contract workers?

No guidance has been issued to date on this point. It is thought that if the term of the fixed contract overlaps with the period of the scheme then they would be covered. If their fixed term contract ends during the period of the scheme there is a question as to whether the employer could extend the contract and allow them to continue to be furloughed. Employers should take advice on this point. It will of course be important that whatever information is required to be submitted to HMRC is accurate.

3. Can the furloughed employee volunteer to undertake work for the employer during the furloughed period?

This is not allowed.

4. Can the furloughed employee volunteer for a third party?

There is no guidance on this point. Our view would be that where the third party is unconnected to the employer that this may be possible but again best to take employment law advice.

5. What about employees with second jobs or who take another job whilst on furlough leave?

If your employee has more than one employer they can be furloughed for each job. Each job is separate, and the cap applies to each employer individually. If an employee takes another job during their furlough leave, this may be a breach in their employment contract.

6. Are directors and shareholder/directors covered by the scheme?

Yes, directors are entitled to take advantage of the Job Retention Scheme as confirmed by both the Treasury and HMRC. They are allowed to perform their statutory obligations only (as per Companies Act 2006) whilst on furlough status.

7. I am paid on an annual basis, what should I do?

Subject to contractual arrangements, it is suggested that sole directors move to a monthly basis from April 2020 to ensure that they can lodge claims under the Job Retention Scheme promptly rather than waiting until April 2021

8. Does using the scheme prejudice making an employee redundant beyond the point that the scheme ends?

No. The guidance explicitly states that an employer may need to consider redundancy when the scheme ends. It will be important to follow due process and take advice.

Return to the main contents at the top of the page.

Please contact our team of experts at JRS@jcca.co.uk for more information.