Coronavirus Job Retention Scheme – updated guidance

The Government updated the guidance on the Coronavirus Job Retention Scheme (CJRS) on 4 April 2020. It provides confirmation and clarification on a few points and includes some important changes and additional measures that employers need to be aware of.

New guidance – notification to furloughed employees

A new requirement is that to be eligible for the grant, employers must confirm in writing to their employee that they have been furloughed and a record of this communication must be kept for five years. This is fairly certain to be a review point for HMRC on subsequent audit of claims and is an important compliance point that employers must not miss.

Change – scope of the scheme

The guidance on where the scheme can apply has changed since it was first introduced. The initial guidance stated that employers could use the scheme to cover employees who would be made redundant because of the coronavirus crisis. The updated guidance now states that the scheme is designed to help employers whose operations have been severely affected by the coronavirus to retain their employees and protect the UK economy.

This is arguably drawn wider than the initial guidance but it would suggest that employers should take steps to document how and to what extent they have been impacted.

Confirmation

It has been confirmed that an employee can be furloughed multiple times, subject to each separate instance being for a minimum period of three weeks. This will afford employers some flexibility by allowing rotation and matching the resource with demand.

Clarification – who can be furloughed

Employees with caring responsibilities

Employees who are unable to work because they have caring responsibilities resulting from the coronavirus crisis can be furloughed. For example, employees that need to look after children can be furloughed.

Fixed-term contracts

It has been clarified that a fixed-term contract can be renewed or extended during the furlough period without breaking the terms of the scheme. Where a fixed-term employee’s contract ends because it is not renewed or extended, then the ability to claim the grant will end on the date of contract terminating. It will therefore be important to review dates of fixed-term contracts and ensure they are renewed or extended if the employer wishes to continue to benefit from a grant.

Eligible individuals who are not employees

As well as employees, it has now been clarified that the grant can be claimed for the following if paid via PAYE:

- Office holders including company directors (see note below)

- Salaried members of LLPs

- Agency workers including those employed by umbrella companies

- Limb (b) workers

Company directors

It has been confirmed that company directors, including individuals who are directors of their own personal service companies, can be furloughed. The board should properly record this in a formal minute and in writing to the director concerned. This is an important point for shareholding directors of their own limited companies. The decision and communication must be dealt with formally.

As expected, company directors can carry out duties necessary to fulfil their statutory obligations, provided ‘they do no more than would reasonably be judged for that purpose, for instance, they should not do work of a kind they would carry out in normal circumstances to generate revenue or provide services to or on behalf of their company’.

Every circumstance needs to be considered on its own merits but it is clear that directors should expect some future scrutiny of their activities over the furlough period and may be asked to provide evidence through, for example, email and social media accounts.

Clarification – a furloughed employee can take on a new job whilst on furlough leave

It has now been expressly stated that a furloughed employee can, if contractually allowed, start work with a new employer whilst on furlough leave. A new employee would complete Statement C on the new employee Starter Checklist.

Clarification – how much you can claim

It has been clarified that the grant will be pro-rated if an employee is only furloughed for part of a pay period.

An example would be where an employee is furloughed from 16 March - the March grant (before employer NI and pension) will be the lower of:

- 80% of their salary for a 2 week period;

- £1,250.

The employee would be entitled to receive their salary in full for the first two weeks in March.

It has also been clarified that furlough leave can start from the date that the employee ceases work, not when the decision was made or when the employer wrote to them to confirm their furloughed status. This means that employees who ceased working in early March before the Chancellor’s announcement of the scheme, can be furloughed from the date they ceased working.

Clarification – basis of pay

The basis of the calculation for salaried and variable pay employees remains the same. However, there are some important changes in what payments can be included in the ‘regular wage’ calculations.

Compulsory v Discretionary payments

The updated guidance states that an employer can claim for any regular payments that they are obliged to pay their employees. This includes wages, past overtime, fees and compulsory commission payments. It then goes on to say that discretionary bonuses (including tips), commission payments and non-cash payments should be excluded. This means that troncmaster schemes will not be covered under the scheme.

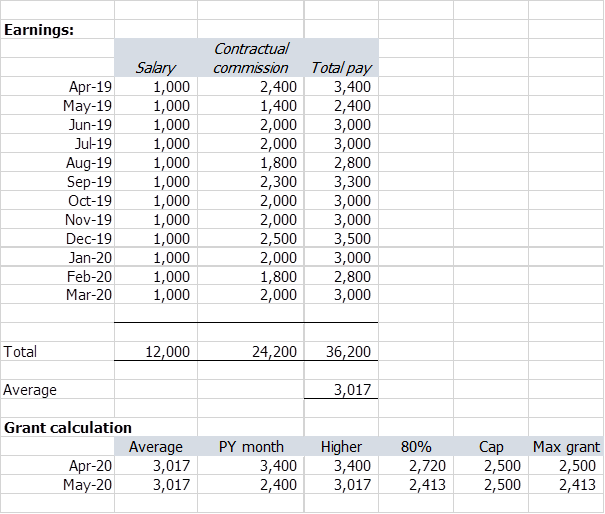

Our reading of this is that ‘compulsory’ should be read as ‘contractual’. Given that some employees rely heavily on the commission part of their pay, we assume from the revised guidance that employees who are contractually entitled to commission can be treated as “Employees whose pay varies” and, as such, that their average pay can be used to calculate the amount due to be paid (and recoverable) under the Scheme, however, further clarification of this point from HMRC would be helpful.

We have included the following example based on our understanding:

Benefits in kind and salary sacrifice schemes

The updated guidance makes it clear that the cost of non-monetary benefits cannot be included in the wage being claimed for. It also clarifies that the reference salary that is used should be after any salary sacrifice.

It then helpfully goes on to say that HMRC has agreed that the coronavirus crisis will count as a life event that could, depending on the terms of the salary sacrifice arrangement, warrant a change to a salary sacrifice arrangement. This would allow employees whose pay is reduced, to reduce their salary sacrificed so as to benefit from an improved take home pay. It will be important to take advice and fully document any change that is implemented.

Get in touch

If you have any queries or concerns about the JRS please get in touch with your usual Johnston Carmichael adviser or alternatively you can contact our dedicated JRS team at: JRS@jcca.co.uk.

We're also running a webinar on this updated guidance and the JRS scheme overall this Wednesday (8 April) at 11.30am. If you're interested in attending, register your free spot through our EventBrite page now,