Changes to capital allowances rate - don’t get caught out with timing

04 December 2018

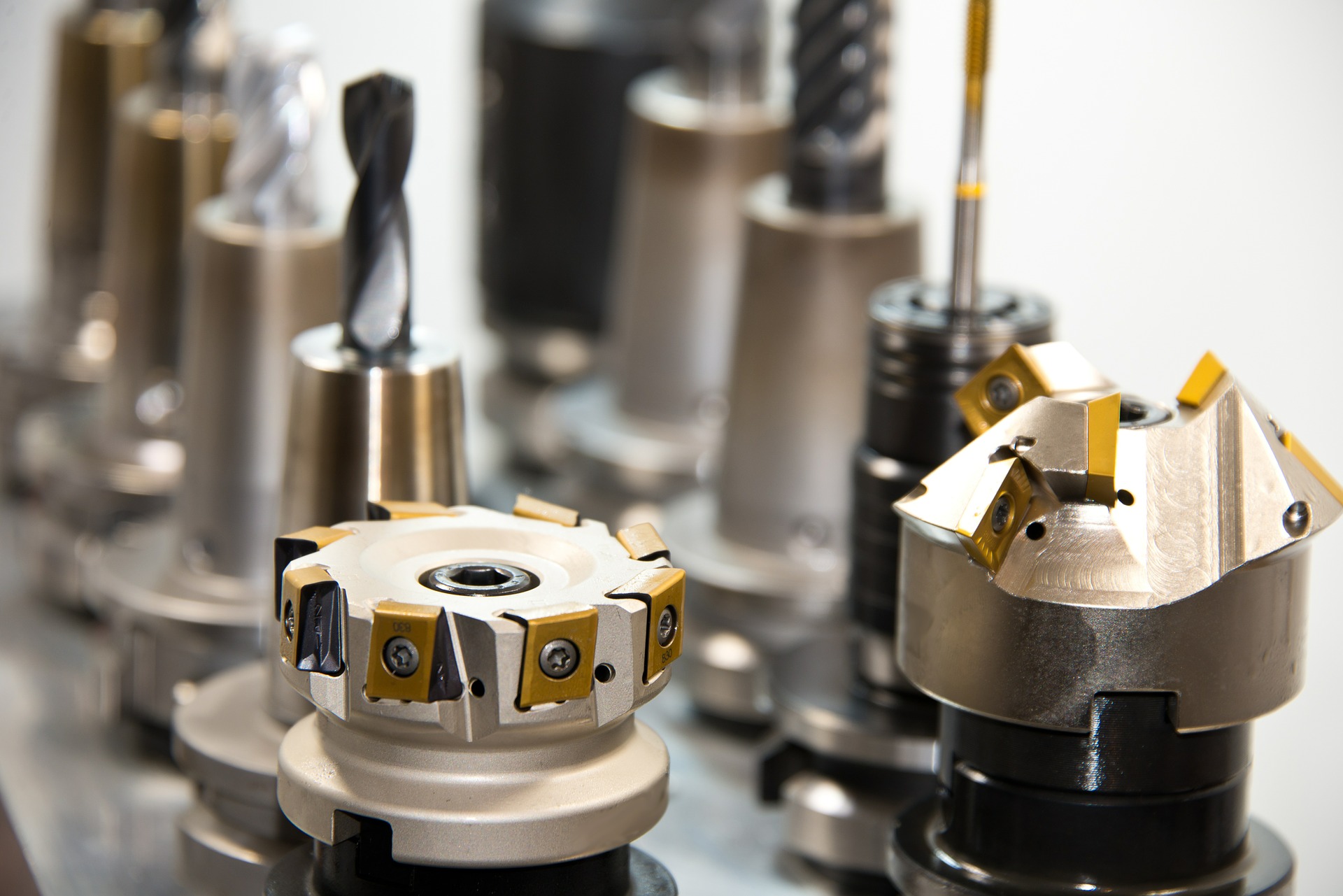

Does your business invest in tools and equipment each year? If so, changes announced to the Annual Investment Allowance in the Autumn Budget may make you think twice before you rush to make these purchases before the end of the year!

What is the Annual Investment Allowance (AIA)?

The AIA allows businesses to deduct the entire value of qualifying capital expenditure from their profit. It’s available for companies, individuals and partnerships - where the partners are all individuals - to claim.

What kind of expenditure is covered?

AIA is available for most assets purchased such as machines and tools, vans, lorries, diggers, office equipment, building fixtures and computers. It doesn’t however, apply to cars.

Expenditure on plant and machinery currently qualifies for Writing Down Allowances at 18% per annum, with a reduced rate of Writing Down Allowances at 8% per annum (reducing to 6% per annum from April 2019) applying to integral features (e.g. electrical systems, cold water systems, heating and lifts) and cars with CO2 emissions above 110 g/km.

AIA accelerates the tax relief available up to the relevant limit, meaning that tax relief can be claimed in the year of expenditure. Whilst it is only a deferral of tax liability it can bring a helpful injection of capital assets to your business to help with your cash flow.

How much AIA can be claimed?

The rate of AIA is currently £200,000 per annum. However, in the 2018 Autumn Budget, the Chancellor announced the rate is rising to £1 million from 1 January 2019 for a two-year period as a means of boosting business investment. Special rules will apply where a business’ accounting year does not coincide with the calendar year. These rules are known as transitional rules.

An example of the transitional rules is the treatment of a 31 March 2019 year end. The maximum AIA that can be claimed would be as follows:

| Proportion from 1 April 2018 – 31 December 2018 (9/12 x £200,000) | £150,000 |

| Proportion from 1 January 2019 – 31 March 2019 (3/12 x £1,000,000) | £250,000 |

| Maximum for the accounting period | £400,000 |

In this case, the transitional rules would allow a business to claim AIA of up to the previous £200,000 limit on qualifying expenditure before 31 December 2018. The entire £400,000 maximum for the accounting period could be spent on qualifying expenditure between 1 January 2019 and 31 March 2019.

How does the timing of expenditure impact on the allowances available?

In order to maximise the benefit from AIA, it is essential that businesses plan the timing of any expenditure carefully as the timing of expenditure could have a significant impact on the allowances available. A £350,000 machine bought in January 2019 by a business with a 31 March 2019 year end could receive AIA on the total cost if the AIA limit was not already used, whereas that same business making the expenditure in December 2018 would only receive AIA of £200,000 and Writing Down Allowance at 18% per annum on the remaining £150,000.

Special rules on the timing of expenditure apply where the asset is bought on hire purchase. Capital allowances can only be claimed when a hire purchase asset is brought into use, so the timing of this could influence the maximum AIA that could be claimed by a business where the year-end does not coincide with the calendar year.

Other AIA considerations

It is important to remember that AIA is an accelerated tax relief and not an additional tax relief to the capital allowances a business would otherwise be able to claim, meaning it could potentially create tax problems for your business going forward. With AIA, all available tax relief on machinery purchased is claimed at the outset which could potentially result in unexpected tax liabilities in future years, especially in years where qualifying capital expenditure is minimal.

In addition, if you sell machinery, this can increase your taxable profits - if you sell a machine on which you previously claimed 100% tax relief, the full sale proceeds may become taxable. However, if this machine is traded in and replaced, it will often have minimal impact as the replacement machine will in turn attract tax relief. But it could create significant tax problems to businesses that are downsizing or selling off excess assets.

The importance of tax planning advice

Therefore, if you are planning on buying new machinery and equipment, care must be taken on when the expenditure is incurred and professional tax advice in advance of any significant purchase may be beneficial to ensure that the maximum allowances for your circumstances are claimed. Get in touch with me or your usual Johnston Carmichael contact to chat through your requirements.