National Insurance rise to be reversed in November

22 September 2022

The controversial tax rise was only introduced in April to fund health and social care, but Prime Minister Liz Truss had pledged to scrap the rise during the campaign to become the next Tory leader.

Her Chancellor confirmed the rise would be scrapped and National Insurance contributions therefore reverted to their 2021-22 levels from 6 November this year.

Chancellor Kwasi Kwarteng said: "Taxing our way to prosperity has never worked. To raise living standards for all, we need to be unapologetic about growing our economy. Cutting tax is crucial to this."

What happened in April 2022?

On 6 April 2022, National Insurance contributions increased by 1.25% for both employees and employers.

- Employee: 12% to 13.25% (UEL) and 2% to 3.25% (UEL +).

- Employer: 13.8% to 15.05%

What happened in July 2022?

On 6 July 2022, the primary threshold increased to £12,570 and align with personal allowance. These changes also applied to class 4 NIC (self-employed) with that rate increasing from 9% to 10.25% up to UEL/above UEL is also 3.25%.

What will happen in November 2022?

On 6 November 2022, National Insurance contributions decreased by 1.25% for both employees and employers.

- Employee: 13.25% to 12% (UEL) and 3.25% to 2% (UEL +).

- Employer: 15.05% to 13.8%

How much less will employees pay?

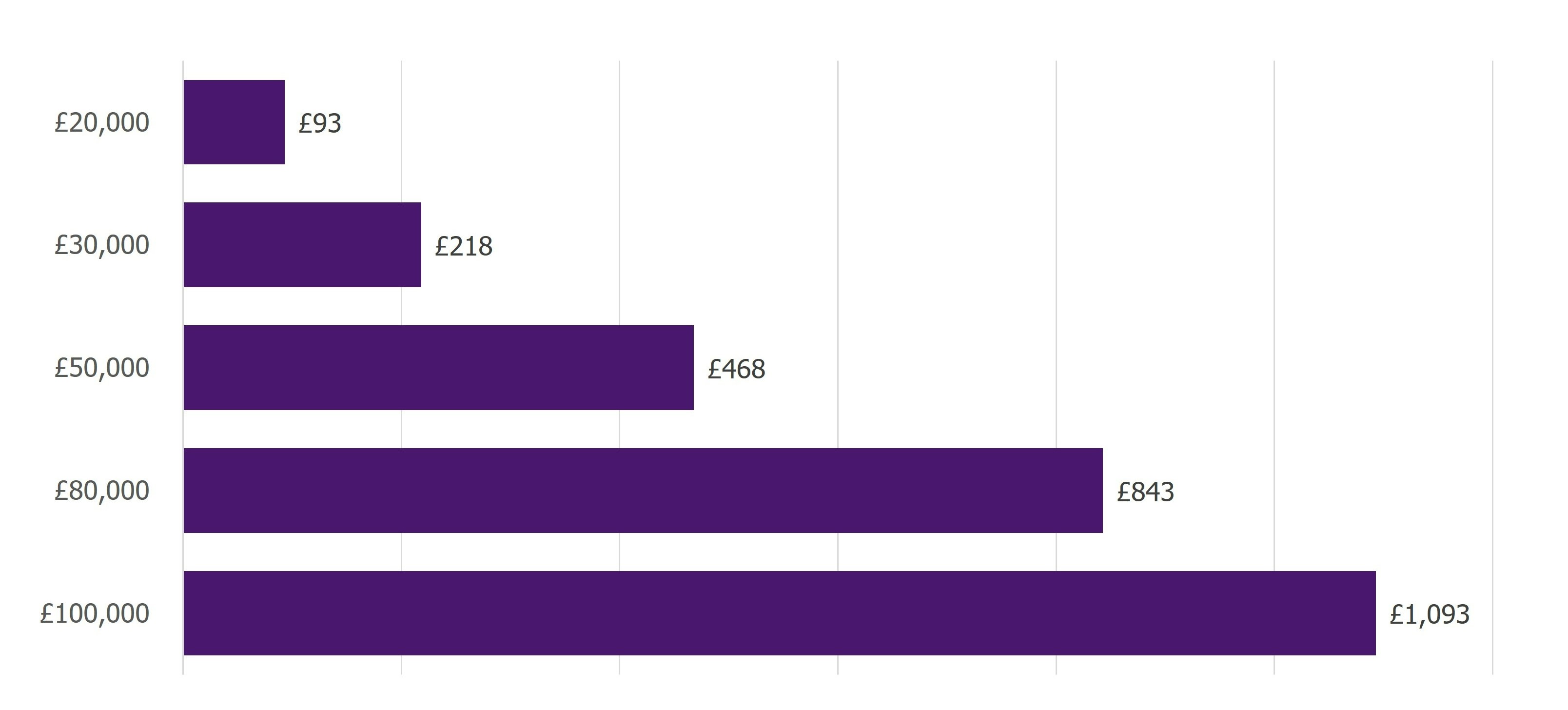

Savings in the first year from introducing Health and Social Care Levy

Note: Assumes no changes in thresholds

As employers navigate through an already difficult period with financial forecasting, we are already having to explain why employees are noticing such a fluctuation in national insurance which will impact the overall net payment due to each employee dependant on their pay frequency. We have included an example below of someone earning £30,000 per annum to let you see the true impact as we migrate from October 2022 into November 2022.

You will note that the primary threshold is set to remain at 1,048 per month which was announced back in July 2022. The secondary threshold is also unaffected and will be calculated using the official 2022-23 bandings.

You can see that on average, employers will save around £108 per employee based on a 30K annual salary on payroll costs from November 2022 to March 2023. Employers who have forecasted already for the original rates may wish to reinvest this saving into employee pensions or enhanced salary compensation.

Net saving per employee on an average salary of £30,000.

| October 2022 | November 2022 | Reduction | |||||

|---|---|---|---|---|---|---|---|

| Base Salary | £2,500 | *£30,000/12 | £2,500 | *30,000/12 | |||

| NIC Employee | £192.39 | *(2,500 - 1,048 (PT) = 1,452 * 13.25%) | £174.24 | *(2,500 - 1048 (PT) = 1,452 * 12%) | £18.15 | Employee | |

| NIC Employer | £262.17 | *(2,500 - 758 (ST) = 1,742 * 15.05%) | £240.40 | * (2,500 - 758 (ST) = 1,742 * 13.8%) | £21.77 | Employer | |

Operationally, how will this work?

Payroll software providers once again had to roll up their sleeves and rebuild the NI categories within each payroll platform – both desktop and cloud.

Thankfully, software was updated from tax month 8 (November 2022) although some software did require additional time.

Employers will also need to consider director payroll calculations who have already finalised their annual pay-run. A small refund may be due based on the timing of the RTI filing. For directors, a blended rate has been introduced to reflect the changes to national insurance. This will mean that 12% will become 12.73%, 2% will become 2.73% and the employer element will increase to 14.53%. We expect further technical guidance in due course.

Payslip Messaging

HM Revenue & Customs previously asked employers and software developers to include a temporary generic message on payslips for the tax year (2022 to 2023) to explain the reason for the NICs uplift.

This message will not be applicable from 6 November 2022, and it should be removed from payslips with effect from this date. If you outsource your payroll to Johnston Carmichael, we will automatically remove this on your behalf.

As a reminder, this wasn’t a legal requirement so if you are not including this payslip message already then, no action is required

I outsource with Johnston Carmichael, what will happen?

We already handled this change for all of our clients and delighted to confirm that we are fully operational with the revised NIC rates from 6 November 2022

Get in touch

If you would like to discuss this further, please don't hesitate to get in touch with myself, a member of our Payroll team, or your usual Johnston Carmichael adviser.