Making Tax Digital is a key part of the Government's initiative to make it easier for individuals and businesses to get their tax right and keep on top of their affairs through a fully digital tax system.

The initial roll-out of Making Tax Digital has already started. Every small business owner and individual taxpayer now has an HMRC digital account that they can access to check their records and manage their information.

Making Tax Digital for VAT

The first stage of Making Tax Digital (MTD), MTD for VAT, came into effect for the majority of VAT registered businesses above the VAT threshold (£85k) in April 2019.

Digital link compliance became mandatory in April 2021, and for all remaining VAT-registered businesses full compliance to MTD for VAT came into effect in April 2022 (unless you have an HMRC approved exemption in place).

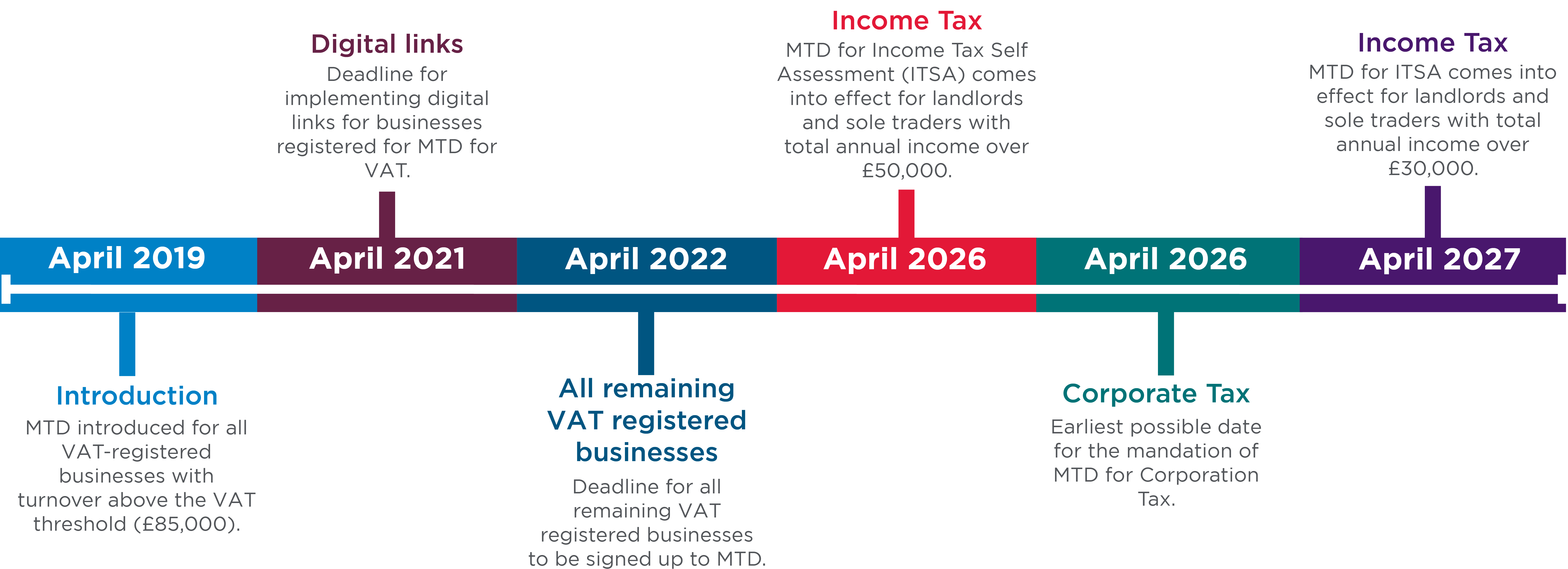

Making Tax Digital timeline

Looking ahead, there are two more Making Tax Digital milestones in sight for businesses and individuals alike, with income tax becoming digital in 2026, followed by corporation tax in 2026 at the earliest:

The introduction of the Making Tax Digital rules is the most fundamental change to the administration of the tax system for two decades. The changes are so fundamental, it's important to understand what's involved when doing your income tax self-assessment (ITSA) and what these rules mean for your business and personal income tax reporting.

Making Tax Digital for ITSA

April 2026: MTD for ITSA - £50,000 Threshold

Making Tax Digital for Income Tax Self-Assessment will come into effect for sole traders and landlords with a total annual income above £50,000. They will need to use compatible software to keep digital records and file returns, including sending quarterly updates and a final declaration each year.

April 2027: MTD for ITSA - £30,000 Threshold

This stage will see the extension of MTD for ITSA to sole traders and landlords with annual incomes above £30,000.

Future developments

HMRC is considering how MTD for ITSA might apply to smaller businesses with annual incomes less than £30,000.

There are also plans for MTD for Corporation Tax, with the earliest possible implementation in 2026.

How will Making Tax Digital help me manage my tax and my reporting?

It's hoped that keeping digital records will offer many benefits by helping businesses manage their taxes more effectively throug

- Providing a complete picture of your business – through your digital account you will be able to see an overview of your tax affairs and manage liabilities at the same time.

- Near real-time reporting – HMRC aim to collect and process tax information in as near to real-time as possible.

- Knowing your tax liability – no longer will you need to wait until the end of the tax year to know how much tax you are due to pay.

Who is exempt from Making Tax Digital?

Making Tax Digital will apply to a range of taxpayers over time, including most businesses, self-employed people, landlords and individual taxpayers, but there are a few exceptions.

The exemption criteria for Making Tax Digital for ITSA are similar to those for MTD for VAT. You can apply for an exemption from MTD for ITSA if you consider yourself to be digitally excluded. This might be the case if it's not practical for you to use software for keeping digital records or submitting them, which could be due to reasons like age, disability, your location (such as a remote area with poor internet connectivity), or religious beliefs.

Just like with MTD for VAT, each application for exemption from MTD for ITSA is considered on a case-by-case basis by HMRC. If HMRC has already confirmed your exemption from MTD for VAT for one of these reasons, you won't need to apply separately for an exemption from MTD for ITSA.

In terms of compliance, MTD for ITSA requires you to maintain digital records of your income and expenses, and to send digital quarterly summaries to HMRC. Based on the figures you send each quarter, you'll receive an estimate of your tax liability. At the end of the tax year, you need to make an end of period statement (EOPS) and a final declaration, at which point HMRC will inform you of your tax due for that year.

If you don't have a justifiable reason for exemption and fail to comply with these requirements, you may face penalties. However, HMRC will offer alternative solutions to those who are granted an exemption.

For more detailed information, you can visit the gov.uk guidance page on applying for an exemption from Making Tax Digital for Income Tax.

Which software is compliant?

HMRC has issued a list of software providers that can or will offer either MTD compatible software for systems or API software.

Compliant software should be able to record and preserve digital records and send and receive VAT return information to HMRC digitally via a special link. There are various off-the-shelf software packages available, some of which will include the capability to record transactions digitally, keep digital records and submit returns via a digital link. Where this capability is not available, bridging software can be purchased to enable you to link digitally to HMRC's systems.

Got a question?

We can help you review your system and suggest the best process for you and your business. Find out more about our Digital Advisory team and arrange a free consultation with one of our advisers.

View our other services

Arrange a free consultation with the team now

Have a general enquiry? Get in touch.