Value creation from exiting a private equity transaction

07 September 2023

Private equity (PE) investors will look to exit their investment at a point when, alongside the wider shareholders, they will make a substantial return on their investment.

As discussed in the first blog in our series, founder shareholders and management should look to agree at the outset with their investment partners what the exit strategy looks like in terms of time horizon together with whether an exit is likely to be best achieved via a trade sale, selling to another private equity house or a flotation.

As outlined in the first and second blogs, private equity provides businesses with the opportunity to accelerate growth and to generate additional value for all shareholders. The example set out below highlights the material value creation for shareholders as a result of private equity investment in a business.

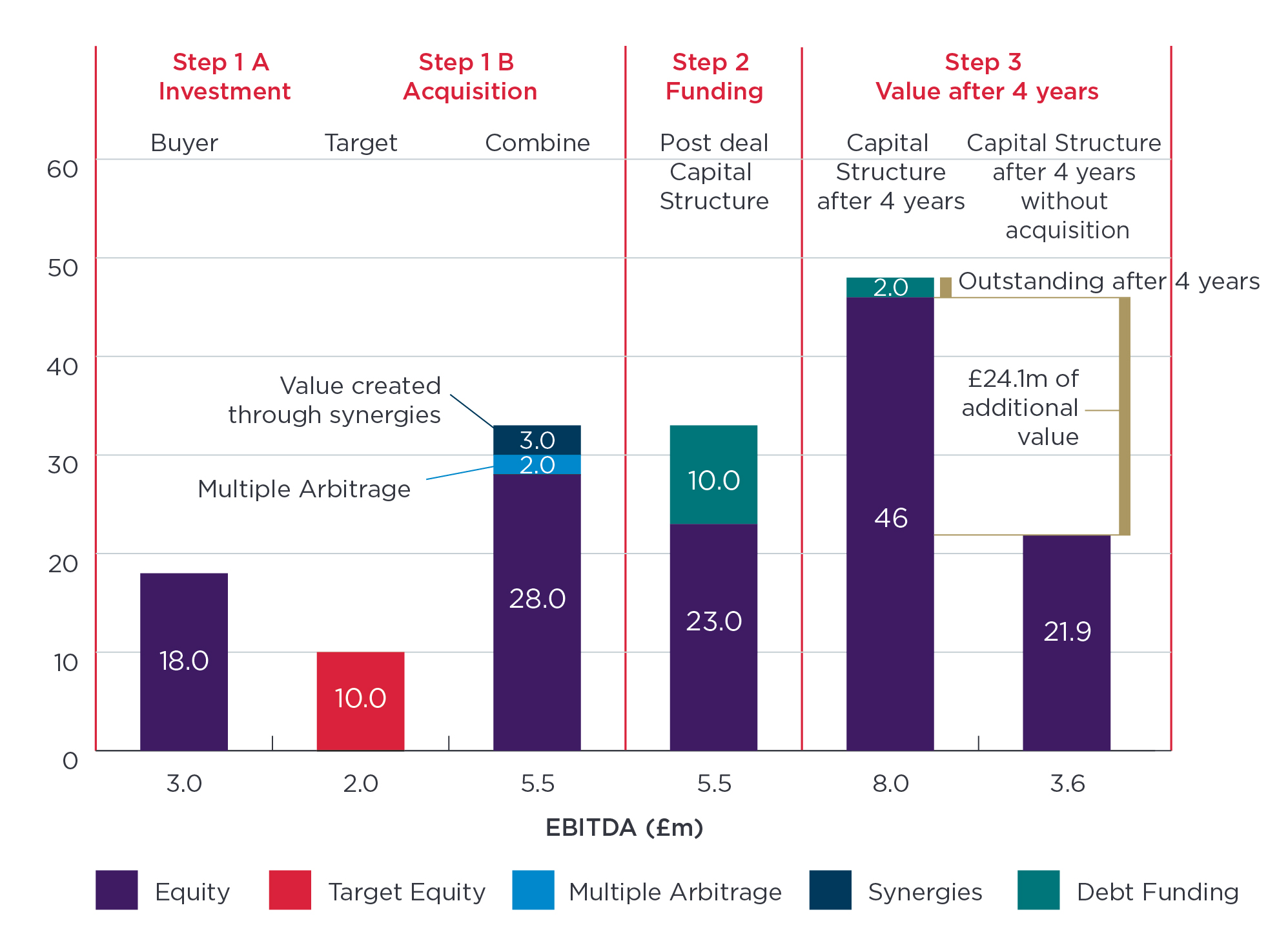

Step 1: investment

- A PE fund invests £10.8m into a business in return for 60% of equity based on an Enterprise Value of £18m (six x EBITDA). £8.8m goes to the existing shareholders, with £2m remaining with the business to invest in growth initiatives.

- Following the investment, an acquisition is made of a £2m EBITDA business based on a five x EBITDA Enterprise Value (£10m).

- By becoming part of a larger business that is valued at six x EBITDA, there is an immediate uplift in value of the acquisition of £2m (the difference between five and six x EBITDA of £2m) – referred to as "multiple arbitrage" (see our blog here).

- Part of the acquisition strategy was the benefit of £500k of immediate cost synergies identified which provides a further uplift in value of £3m (£0.5m EBITDA x six).

Step 2: acquisition funding

- £10m of debt is used to fund the acquisition.

- The post-deal capital structure therefore shows £23m of equity value available to shareholders (total value £33m less £10m of debt).

Step 3: exit after four years

- With the support of PE, the EBITDA has grown by 10% per annum over the four year period to £8m. Assuming the same exit multiple as entry multiple of six x the EV is now £48m, with £46m available to shareholders after deducting the outstanding £2m of debt.

- As discussed previously, PE investors would look to exit their investment on a higher valuation multiple than when they made their initial investment. For example, a seven x EBITDA exit multiple would generate an additional £8m of shareholder value than outlined in the example.

- Compare this to the scenario where the PE investment did not take place and the business grew at 5% per annum. The value in year four based on a six x EBITDA multiple is £21.9m.

- The table above shows that the PE investment has helped generate additional value of £24m to shareholders in the period.

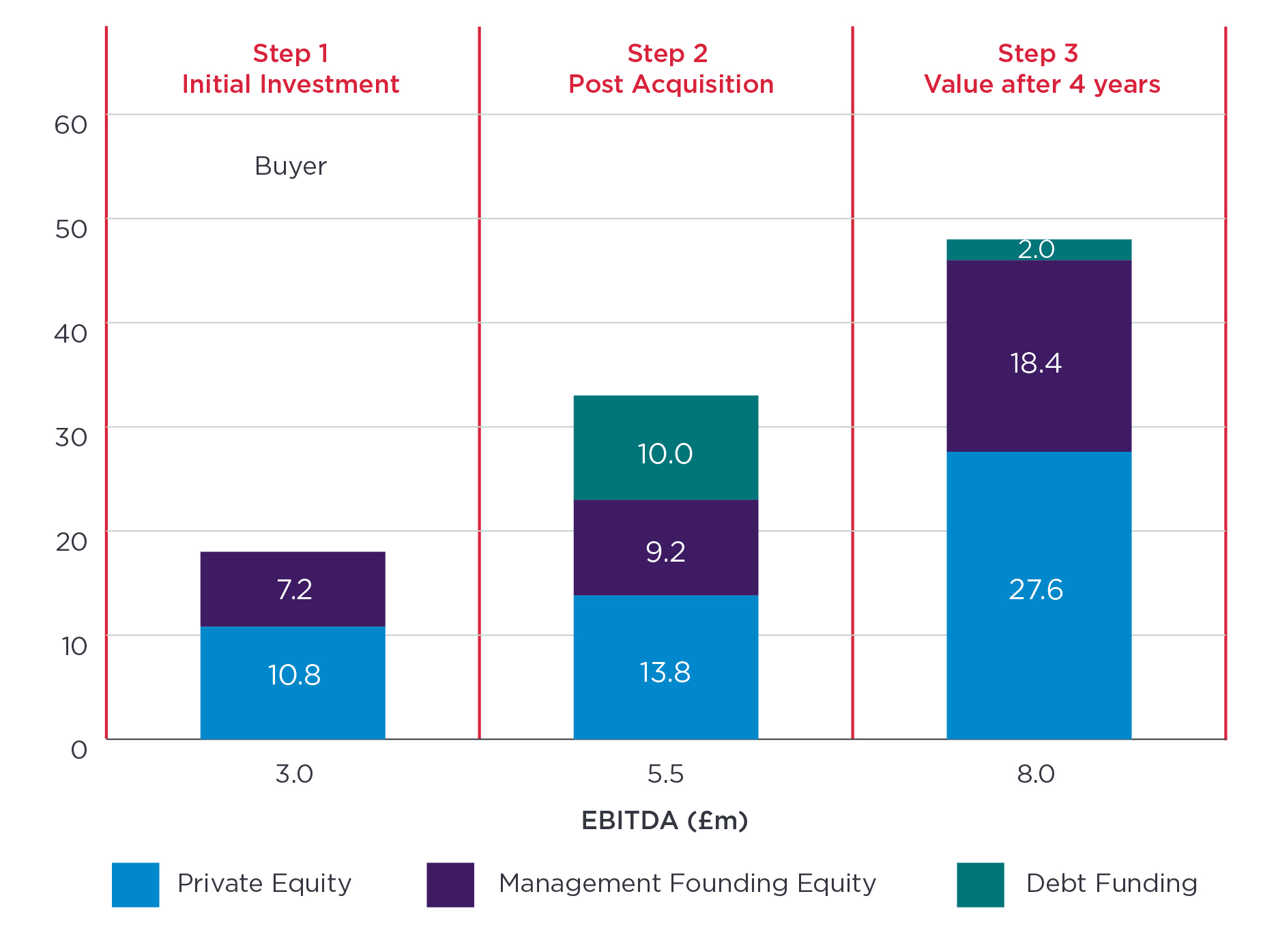

Creating additional value for shareholders/management

The additional value generated for the founding shareholders/management as a result of the private equity transaction is outlined below:

A combination of £8.8m of money out at step one, together with a share in the ultimate exit value of £18.4m, has created total value for the original shareholders of £27.2m v £21.9m had the business remained in their ownership and grew at 5% p.a.

As well as creating significant additional value, the private equity investment has allowed the shareholders to materially de-risk their position by realising substantial value (£8.8m of cash) at the point of the equity investment.

Summary

As this series has outlined, private equity can play a significant role in accelerating the growth of a business and helping shareholders and management teams to realise their ambitions for their business. Whilst most private equity investors will require a material equity stake in companies in which they invest, having an experienced investor partner provides an opportunity for original shareholders and wider management to significantly increase their overall returns through a combination of getting money off the table and maintaining a meaningful stake in the business.

Find out more

If you would like to discuss this further, please don't hesitate to get in touch with me, or a member of the Corporate Finance team.